Key drivers of corruption risks in tax administration include overly complex tax regulations, a weak sanctioning regime, a lack of meritocratic recruitment, a lack of checks and balances, modes of tax collection based on frequent in-person interaction.

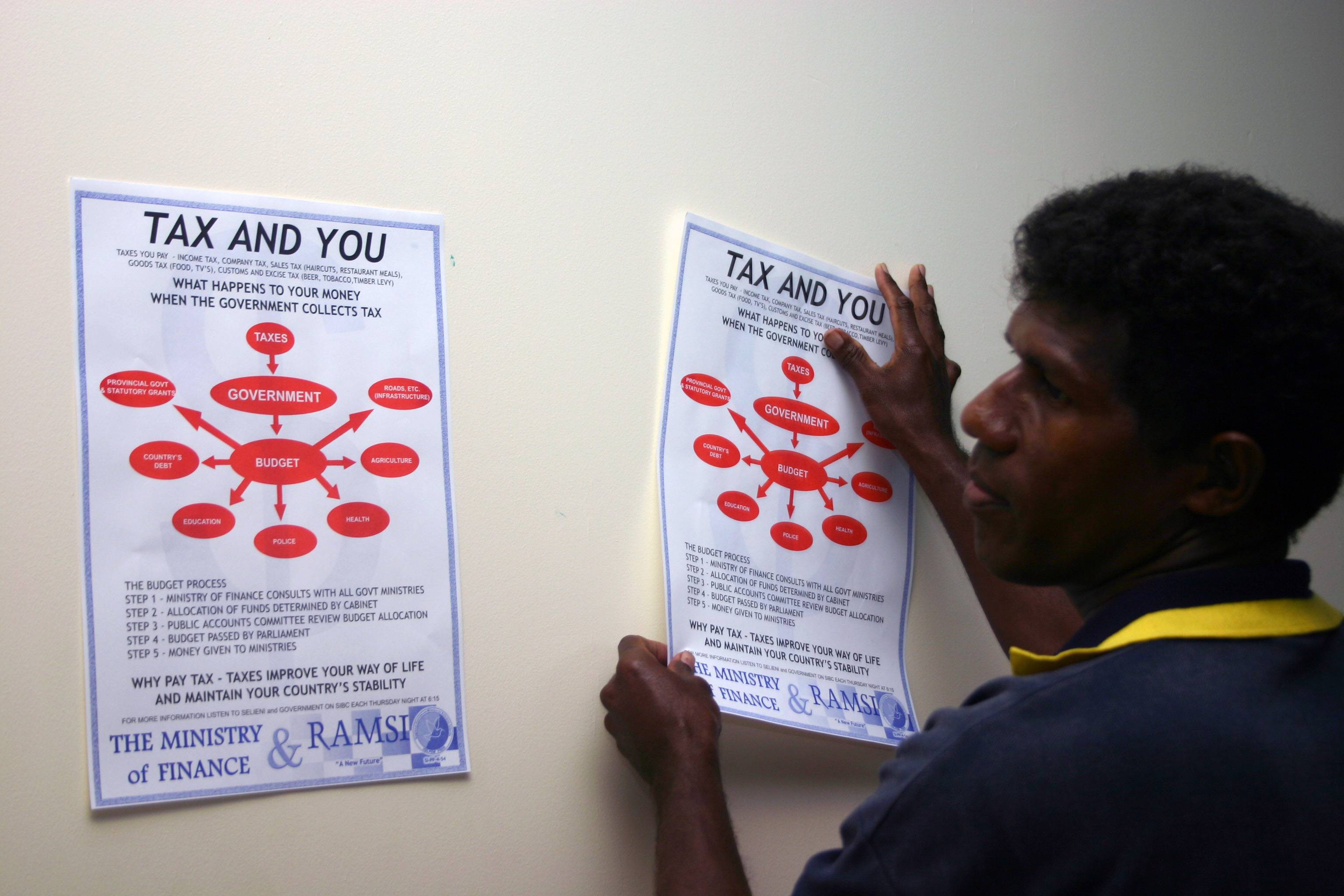

Photo:

DFAT

CC BYtopic

Tax and revenue collection

Corruption and anti-corruption efforts in tax and revenue collection

Featured content

From the blog

Latest publications

Related topics

Budget process

Addressing corruption in the public budget process

Updated 28 October 2021

Procurement

Corruption and anti-corruption efforts in procurement

Updated 26 October 2021

Public financial management

Corruption and anti-corruption efforts in public financial management

Updated 28 January 2022

Public sector accounting

Corruption and anti-corruption measures in public sector accounting

Updated 26 October 2021

Auditing and financial control

Corruption and anti-corruption measures related to public auditing and financial control systems

Updated 28 October 2021