Caveat

Considering the volume of illicit gold trade in the Democratic Republic of Congo (DRC) and the extent of research available on the country relative to other East and Central African states, the discussion on source countries of illicit gold flows will focus primarily on the DRC.

Background and introduction

Gold is a precious metal, distinct from other minerals due to its diverse uses. For instance, it can be used as a currency, a commercial tool, as well as a financial instrument during economic crisis (Hunter et al. 2017:6). Some of its inherent characteristics, which include anonymity, ease of movement, and global fungibility (Hunter 2019:3; Grynberg and Singogo 2019), tend to create a fertile ground for illicit activities. Compared to other commodities, it is low-risk, with high-returns, which make it vulnerable to illicit actors and criminal exploitation (Hunter 2019; Hunter et al. 2021).

Illegal gold mining includes all activities and actors related to mining, trading, and financing that are contrary to the laws of the jurisdiction in question (Interpol 2021:8). It tends to be fuelled by limited access to land and mineral rights. For instance, red tape and regulatory frameworks can prevent small-scale actors from legally accessing the mining industry, which further facilitates illicit activities (Hunter et al. 2021).

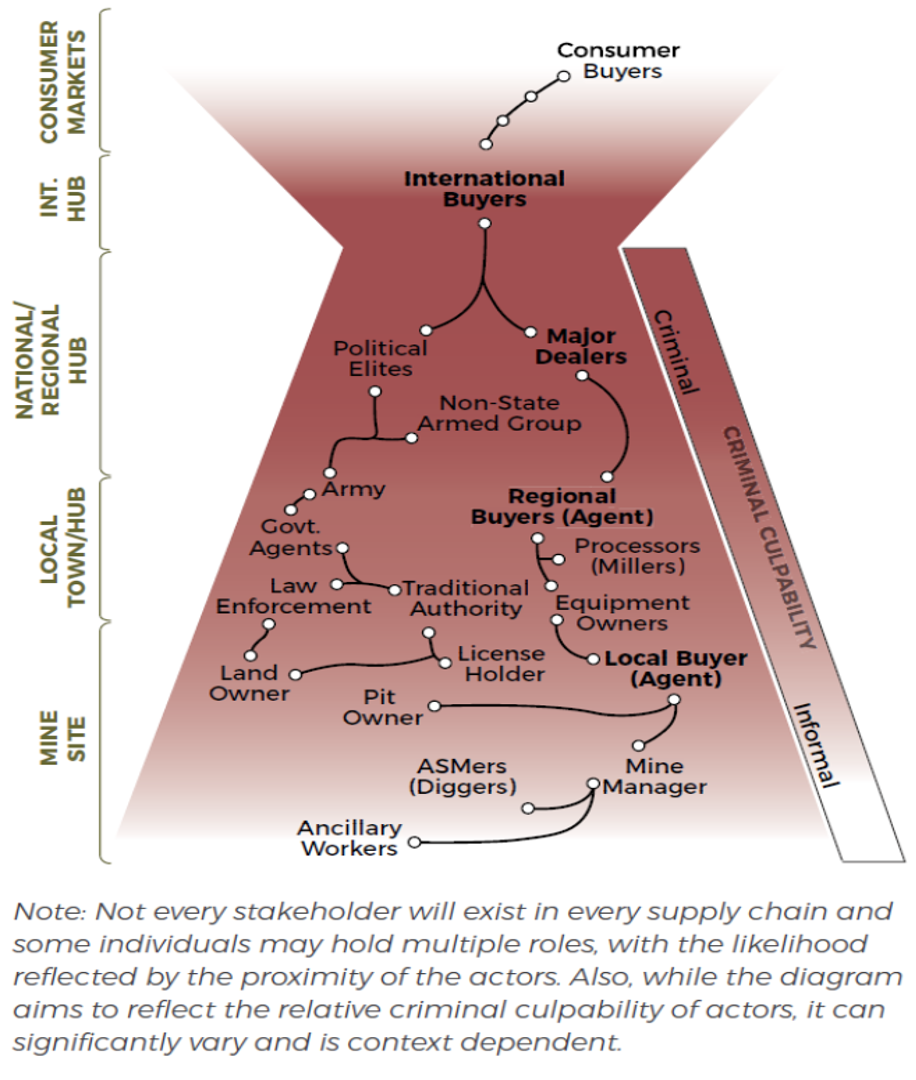

Many players are involved at different stages of illicit gold flows. For instance, actors at the mining site could include diggers, mine manager, pit owner and local buyers. At local town/hub, actors could include law enforcement, traditional authority, equipment owners, government agents, processors/millers, regional buyers, as well as the army. Actors at national or regional hubs include non-state armed groups, political elites, and major dealers, whereas at international hubs this includes international buyers (Hunter et al. 2021: 39-44; Interpol 2021: 27-28).

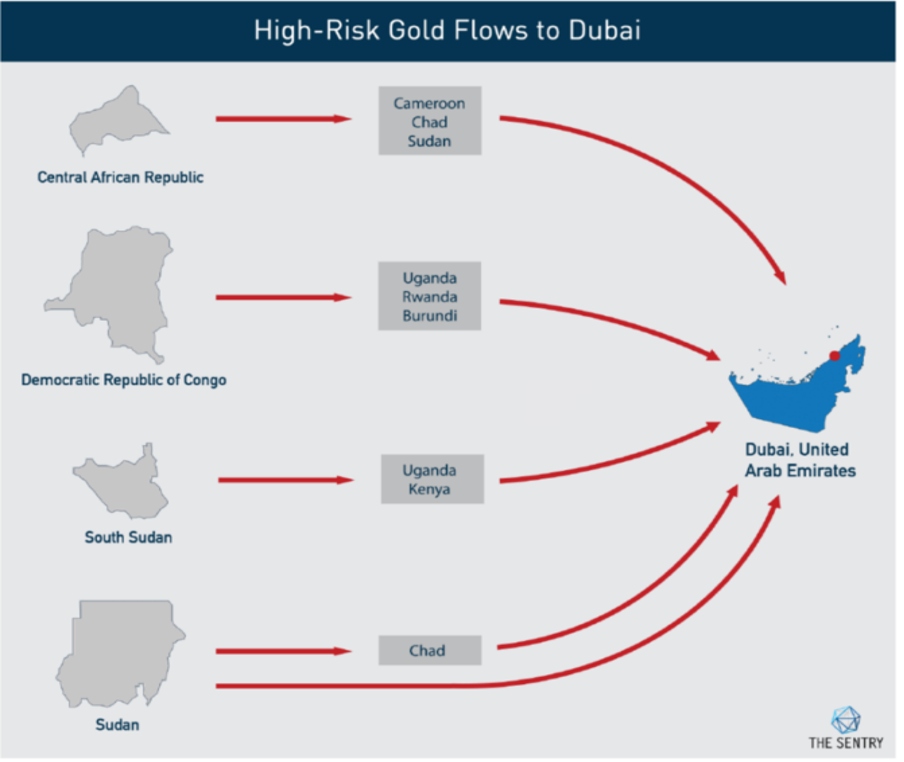

Evidence indicate that key illicit gold flow routes within the Central and East Africa region include: DRC to Uganda, Rwanda and Burundi; CAR to Cameroon, Chad and Sudan; and South Sudan to Uganda and Rwanda (see Lezhnven and Swamy 2020:4; Interpol 2021).

Evidence also show that billions of US dollars worth of gold are smuggled every year from Africa through the UAE, which is a main regional hub for distributing gold to other markets (Lewis et al. 2019; Reuters 2019). This can be seen by comparing the official gold export figures of African countries, and official import figures from the UAE (Grynberg et al. 2019).

For instance, Cameroon recorded only 4 kg was exported to UAE in 2017, whereas the UAE recorded to have imported 10.9 tons of gold from Cameroon during that period (Interpol 2021: 15). According to Interpol (2021: 15), “assuming all gold did in fact originate in Cameroon, this figure would indicate that most Cameroonian gold production was smuggled from Cameroon to the UAE in 2017.” Alternatively, if it was considered that Cameroon produced a low estimate of 7 tons during that period, “it would suggest that foreign gold entered Cameroon to be exported as Cameroonian gold, and that Cameroon would be a transit country for gold originating from other countries of the region” (Interpol 2021: 15).

Similar discrepancies can be observed in the case of Uganda, whose official figures on exports to the UAE are less than the official imports declared by the UAE, especially since 2018 (Figure 2). As will be discussed in detail in the following sections, it is believed that Uganda’s exports include gold smuggled from the DRC and South Sudan (Hunter et al. 2021).

Main typologies of illicit gold flows

According to one Interpol report (2021:9), there are three main types of gold exploitation in the Central African region:

- artisanal and small-scale gold mining (ASGM)

- large scale or industrial gold mining (LSGM) – this typically involves multinational companies, who use advanced technology and qualified personnel (Interpol 2021:13); and

- hybrid type – combines the features of ASGM with the use of mechanisation and equipment (see also Somda no date).

Extensive research has been carried out on illicit gold flows linked to ASGM, while much less has been written on illicit trade from other types of gold exploitation in East and Central Africa. The existing studies and investigative reports on LSGM suggest alleged practices of tax avoidance and tax evasion by companies involved in this sector. For instance, in 2017, the Tanzanian government imposed a hefty fine on the UK-based mining company, Acacia Mining, for allegedly operating illegally in the country and failing to fully disclose its earnings (Dahir 2017; Kazeem 2017). The majority owner of the company’s equity stakes, Toronto-based Barrick Gold, agreed to a deal, which included a fine of US$300 million, and offering stakes in the company to the Tanzanian government, among other concessions (Dahir 2017).

The focus in this paper will be mostly on illicit gold flows from ASGM. Although there is no universally accepted definition of ASGM (partly due to its contextual variations), some of its main characteristics include: low levels of technology and a limited use of mechanisation; low productivity; lack of environmental protection; and poor health care standards (Hunter et al. 2017:4).

Research suggests that ASGM, which is common in the gold industry in the Central African region, is mainly illegal (Interpol 2021:4). As the presence of the ASGM sector sometimes benefits armed groups, ASGM gold is occasionally characterised as a conflict mineral. However, it is important to note that even in non-conflict countries, ASGM is often associated with weak government oversight and regulation, smuggling, and illegal exports (Blore and Hunter 2020).

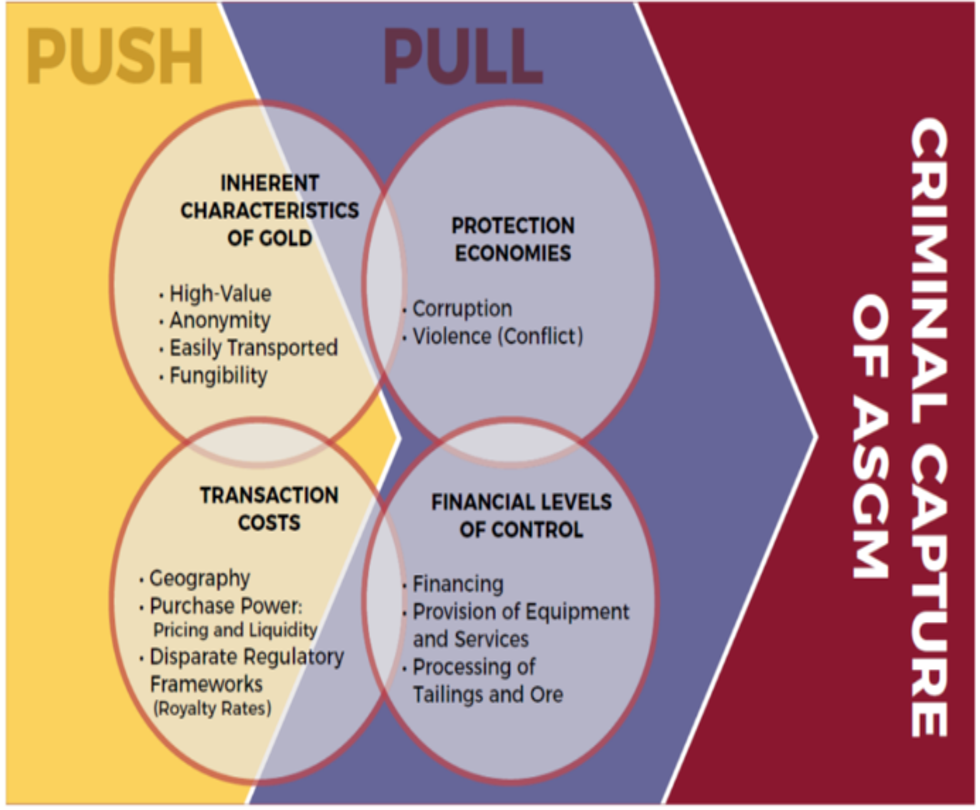

Hunter (2019: 2) addresses the tactics and factors that facilitate exploitation and criminal capture of the ASGM sector in Africa. She distinguishes between push factors which attract illicit actors, such inherent characteristics of gold, and efforts to lower the transaction costs in both legal and illegal ways, and pull factors which refer to tactics used by illicit actors to capture the sector. These include use of protection economies, which refers to the use of corruption and violence to secure illicit rents, and financial levers of control, which refer to controlling access to finance and equipment and owning gold processing facilities (Figure 1).

Figure 1.Drivers of criminal capture in the ASGM sector. Source: Hunter 2019:15.

Corruption and criminal activity in illicit gold flows range from informal and small-scale illegal activities, typically at the level of mine sites and bribes to low-level officials, up to grand corruption by political elites and criminal consortia (Hunter 2019; Hunter et al. 2021). For instance, in Uganda and South Sudan, allegations of involvement of military officers and politicians at the highest levels of government in illicit gold flows are widespread (Hunter et al. 2021:39).

Main actors in key routes of illicit gold flows

Main actors of illicit gold flows - classifications

Recent studies have attempted to classify the most important players in the supply chain of illicit gold flows (Hunter 2019; Hunter et al. 2021; Interpol 2021). As Hunter (2019) points out, it is important to move beyond the conflict context to recognise the multifaceted nature of criminal consortia involved in illicit gold flows, and the multitude of actors and incentives involved. These criminal consortia, defined by Hunter (2019:3) as the intersection of politics, business, and crime, tend to exploit both legitimate and illicit markets for their narrow interests. As will be discussed in detail below, these actors engage in manipulating ASGM operations and related gold trade across Africa for political and economic gains at the cost of vulnerable populations (Hunter 2019:3).

It is also important to recognise that in different contexts, different actors will be the dominant drivers of illicit gold flow networks. It should be noted that the same actors might perform multiple roles in illicit gold supply chains, which poses a challenge to mapping the key players (Hunter et al. 2021).

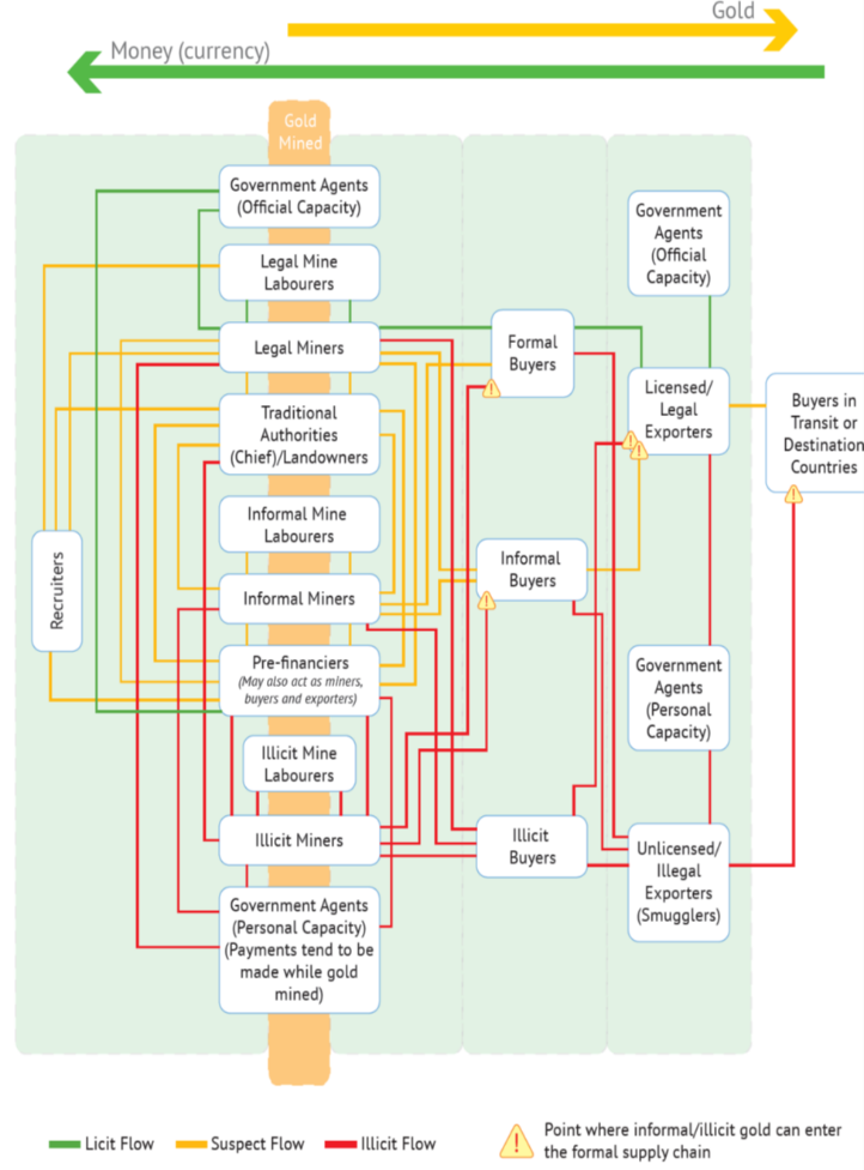

Figure 2.A framework for researching financial flows in ASGM: Suspected financial flows. Source: Hunter et al. 2017:27.

Further, illegal and legal gold supply chains tend to be in competition, and due to the delicate borders between them (see Figure 2), one can easily penetrate the other, which complicates the tracing of illicit gold (Interpol 2021:10; Hunter et al. 2017).

Hunter (2019: 8) provides an exhaustive list of actors at each step in the gold supply chain (see Figure 3):

- At the mining site, the actors include ancillary workers, ‘ASMers’ (diggers), mine manager, pit owner, local buyer (agent), license holder, and owner.

- In the local town/hub these include law enforcement, traditional authority, equipment owners, government agents, processors/millers, regional buyers (agents), and the army.

- National/regional hubs include non-state armed groups, political elites, and major dealers.

- The international hub includes international buyers. Consumer markets include consumer buyers.

Figure 3. The supply chain of gold flows. Source: Hunter 2019:8

Within each of these levels, there are many actors involved, with different levels of criminal culpability. Hunter (2019) argues that criminal culpability is a spectrum ranging from informal activities at the mine site, to criminal involvement as one moves up the supply chain. For example, miners often work legally, selling gold to intermediaries (Lewis et al. 2019). However, moving up the supply chain, gold dealers with strong political ties, or politicians, tend to be the drivers of criminality (Hunter 2019:3).

Depending on the context, different actors participate as either dominant players or enablers of corruption. For example, in conflict zones, it is likely that armed forces (state or non-state) have an important role in facilitating illicit gold flows. The regulatory environment also matters, as lacking a computerised system of cadastral records, for instance, may incentivise political elites to purchase vast swaths of land leading to the capturing of land and mining rights (Hunter et al. 2021).

In cases of ASGM supply chains, there is a limited number of actors who control the network. Hunter (2019) emphasises that these networks tend to be resilient, and despite having a small set of core actors, they tend to be decentralised and less sensitive to disruption. Core actors are typically well hidden behind the network of intermediaries, financial flows, and/or front companies (Martin and Taylor 2014; Hunter 2019; Hunter et al. 2021). These networks, depending on the context, tend to be structured by patron-client ties, traditional local authorities, and family ties (Hunter 2019).

Further, some regional studies on illicit gold flows provide additional useful classifications of the main actors involved in the process. Interpol’s report (2021), focusing on Central Africa, notes that most gold flows via an illegal network of intermediaries who typically comprise unregistered local buyers working for bigger dealers located in trading hubs within Africa. The report identifies the following key criminal stakeholders (Interpol 2021:27-28):

- financiers (located in source, transit, or destination countries, they are enablers of illicit gold mining);

- illegal pit owner or site manager;

- gold mining companies (eg they conceal the real quantity of gold, engage in corruption activities and environmental crimes);

- the refineries (eg involved in obscuring the gold’s origin);

- corrupt elites and civil servants;

- military forces; and

- non-state armed groups (eg involved in controlling mining sites and gold flows, attacking facilities, imposing illegal taxes).

Finally, a recent study (Hunter et al. 2021:39-44) focusing on East and Southern Africa identified the following as key actors in illicit gold flows:

- market actors;

- political actors (they exploit the sector using corruption or force by: 1) instructing law enforcement to crack down on non-aligned mining operations; 2) colluding with business actors and foreign nationals to achieve narrow benefits; and 3) manipulating national policies to hamper competition.);

- law enforcement;

- military;

- foreign nationals (typically influential buyers or investors); and

- gold dealers.

It is important to note that the role actors play can differ by context. Depending on the route, different actors will emerge as dominant ones in controlling or influencing illicit gold flows from Central and East Africa.

Key routes and actors in Central and East Africa

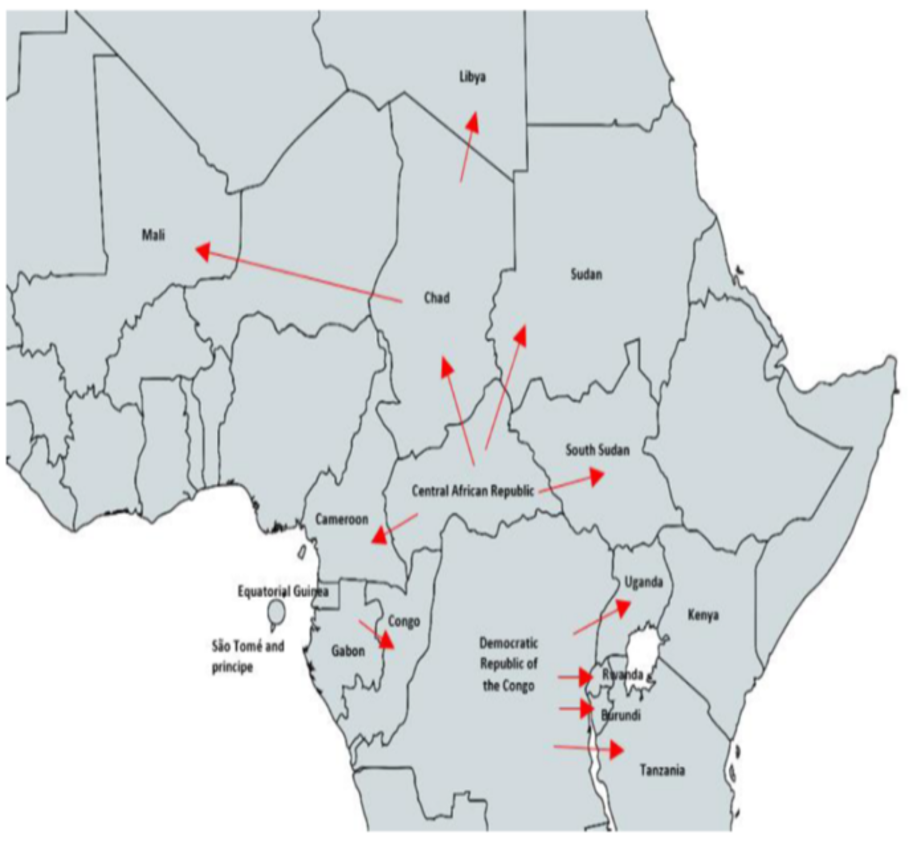

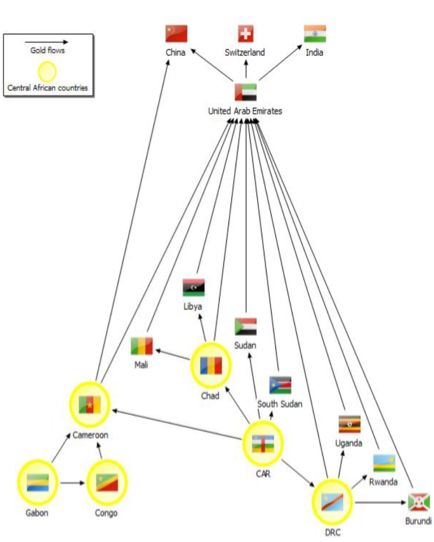

There are several studies that identify the dominant routes of illicit gold flows in Central and East Africa (see Hunter 2019; Lezhnev and Swamy 2020; Interpol 2021; Hunter et al. 2021). For example, a study by Lezhnev and Swamy (2020), focusing on conflict gold, identifies several key high-risk routes in these regions (see Figure 4):

- Democratic Republic of Congo to Uganda, Rwanda and Burundi;

- Central African Republic to Cameroon, Chad, and Sudan; and

- South Sudan to Uganda and Kenya.

Figure 4. High risk gold flows in East and Central Africa. Source: Lezhnev and Swamy 2020:4.

The final destination of all these routes is most often Dubai, UAE (Lezhnev and Swamy 2020:4).

Although Interpol’s (2021) report does not focus exclusively on conflict gold, it identifies similar routes of illicit gold flows as those cited in Lezhnev and Swamy (2020), with some differences. The identified routes in the Interpol report include (see Figure 5):

- Chad to Libya and Mali;

- CAR to South Sudan (in addition to routes identified in the study by Lezhnev and Swamy (2020));

- Gabon to Congo; and

- DRC to Tanzania (in addition to routes identified in the study by Lezhnev and Swamy (2020)).

A map of central Africa, with arrows pointing to and from several countries

Figure 5. Gold flows in the Central African region and beyond. Source: Interpol 2021:19.

According to the same Interpol report (2021:22-24) illicit gold flows in Central and East Africa are facilitated through:

- fraud used by corrupt officials, which has been recognised as an important factor in gold smuggling from the DRC to Uganda (eg forging documents to hide the origin of gold, particularly relevant in conflict zones);

- using front companies with hidden ownership to conceal the gold’s origin;

- mixing or refining golds of different origins to hide the real origin;

- weak enforcement, corruption, and widespread use of bribes;

- disparate regulatory frameworks (eg different tax regimes on gold exports across countries); and

- higher purchasing power of illicit buyers compared to legal ones.

The role of armed actors in illicit gold flows

Armed groups fund some of their activities through their involvement in illicit flows of gold from ASGM, by controlling the mine sites, smuggling routes, and extorting illegal tax (Interpol 2021). These armed groups are mainly active in the DRC, the CAR, Sudan, South Sudan, and in Northern Chad (Lezhnev and Swamy 2020; Interpol 2021). For example, one estimate is that armed groups in the CAR earn at least US$6.5 million annually from roadblocks used to charge illegal taxes (Schouten and Kalessopo 2017).

Transnational organised crime networks have a vested interest in keeping these armed groups active in order to maintain an insecure environment and the continuation of illicit flows of gold and other minerals. Research focusing on the Eastern DRC suggests that armed groups retain only 2% of net profits from illegal smuggling – not limited to gold – while the rest goes to organised crime groups working in and out of the DRC (Interpol 2021; UNEP-MONUSCO-OSESG 2015).

A UN Group of Experts report (2018) suggested that criminal networks and armed groups, including national security officers, use gold and illegal taxation as a source of illegal revenue in the DRC. Specifically, the UN Group has characterised gold flows from Eastern DRC as well-organised and systematic, with influence typically being hidden behind complex and dispersed networks of intermediaries (Hunter 2019:7; UN Group of Experts 2018). The Interpol report (2021) notes that the DRC is most likely the key source country for illicit gold flows in the Great Lakes Region. Between 10 and 20 tons of gold, worth between US$300 and US$600 million, is smuggled out of the DRC annually, based on an estimate of the UN Group of Experts from 2013 (as cited in Lezhnev 2021:3). Conflict gold provides the biggest revenue source for armed actors in the DRC, who profit from illegal taxation, raiding of mines, as well as collaborating with smugglers (Lezhnev 2021:3; UN Group of Experts 2016).

The UN Group of Experts (2018) claimed that actors within the National Intelligence Agency (ANR) have a role in illicit gold flows in the DRC. For instance, the provincial director of ANR, Jean-Marc Banza, was allegedly involved in gold trade in Ituri province in the DRC. The evidence includes a letter written by the director to the manager of the mining site in the Djugu territory in which he requests rights to a pit for exploitation of gold. The evidence also suggests that members of ANR were frequently sent to mining sites where Banza reportedly held rights to exploitation, and some testimonies suggest that these members made sure that the production was neither recorded officially nor subject to taxation (UN Group of Experts 2018:21).

Further, the evidence collected by the UN Group of Experts (2018:21) has shown that a significant amount of gold traded by Uganda and Rwanda arrives fraudulently from neighbouring countries, including the DRC. For example, the UN Group of Experts (2018:21) collected evidence on smuggling from Bunia in the DRC to Uganda. The research suggested that most of the gold traded in Bunia was illegally sourced. It also noted that gold from Bunia to Uganda travels via road, to the Mahagi territory in DRC. The research suggests that at the border with Uganda on the Congolese side, customs officials were bribed; while on the Ugandan side, there were typically no requests to present documents on the origins of the gold. Furthermore, Mahagi is a well-known route of illicit gold flows from the DRC to Uganda (UN Group of Experts 2018: 22).

There are reports that influential businesspeople and senior members of the Congolese military assist in facilitating illicit gold flows along these routes (Hunter et al. 2021: 32). For instance, there is evidence of illegal taxation by armed actors at roadblocks as well as interference by Congolese army units (Matthysen et al. 2019: 8). Also, reports from the Itebero area in DRC suggest that in 2018 the Armed Forces of the Democratic Republic of Congo (FARDC) organised monthly patrols by the mines to collect contributions (Matthysen et al. 2019: 18). Artisanal miners play a role in this process. It has been reported that pit bosses, in order to prevent possible harassment by rebels, police or administrative authorities, tend to go along with the culture of providing ‘contributions’ to the army (Matthysen et al. 2019:18).

In other parts of the DRC, such as Bukavu, it is common to use forged documents to illegally export gold, and evidence suggests that this practice is facilitated by corrupt officials and a lack of border control (UN Group of Experts 2018). Reports suggest that no less than 300 kg of contraband gold flowed through Bukavu every month in 2018 (Impact 2020; UN Group of Experts 2019a).

The data from Uganda supports the claim that the country receives illicit gold from the DRC. Hunter et al (2021:32), citing an anonymous gold dealer, states that most of the gold that arrives in Uganda is illicit. There are some contextual factors that make Uganda attractive as a receiving country for gold, such as low export royalties and resourceful local buyers who purchase gold at competitive prices (Hunter et al. 2021). For example, in 2017, Uganda announced a 0% tax rate on ASM gold exports, which was expected to further establish the country as a magnet for gold from the region (Enough Team 2020).

Previous research has shown that gold traders in Uganda tend to use companies with hidden ownership to receive smuggled gold from the Eastern DRC (Hunter 2019; Martin and Taylor 2014). These traders would often falsify documents, under-declare gold to avoid taxes, and misrepresent the origin of gold (Martin and Taylor 2014). These illicit practices can partially explain the discrepancies between the officially reported exports of African countries and the officially reported imports of the UAE, as will be discussed in detail in the following section.

Hunter et al (2021:33) note that there are reports of a network of businesspeople in Kasese, a town in Uganda, who control the smuggling of gold between the DRC and Uganda, and employ people on both sides of the border. State officials are also implicated, along with agents of foreign companies (Hunter et al. 2021). Gold is easily moved across the border with the help of these criminal networks. The Mpondwe border between Uganda and DRC, for example, is controlled by a network of businesspeople and local farmers (Hunter et al. 2021:33).

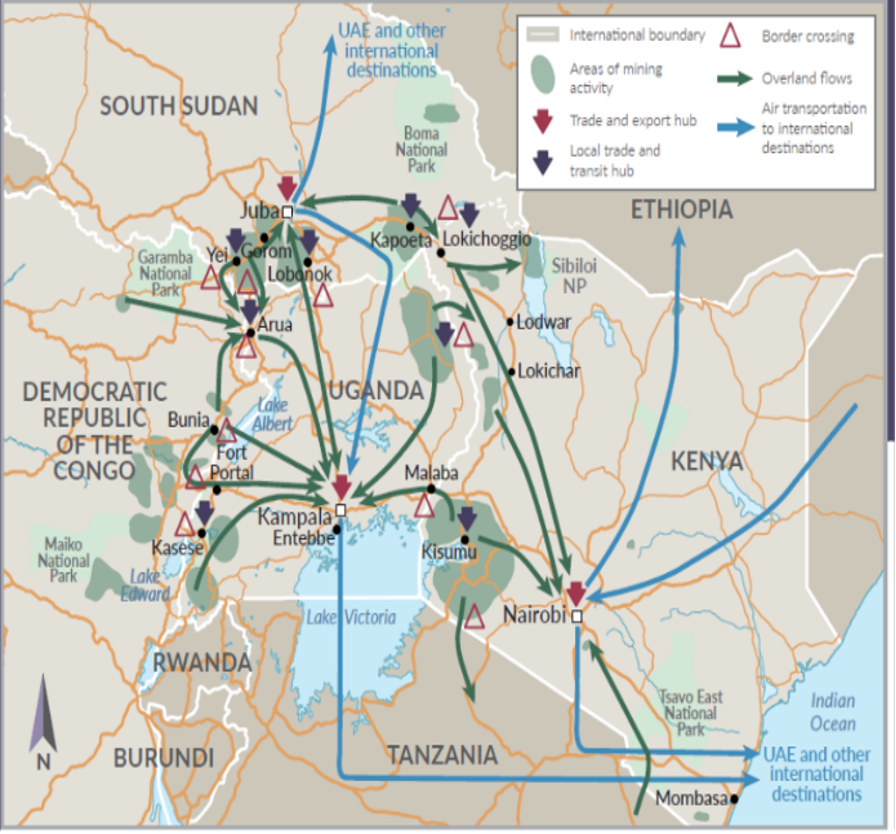

More recent evidence suggests that most gold shops and companies in Kampala, the capital of Uganda, have agents with direct links to big gold producers in eastern DRC, but also ties with the police and military who provide protection during smuggling activities (Hunter et al. 2021:32). Prominent points of illicit gold flows in Uganda are Arua and Kasese, while dealers also use Lake Albert and Lake Edward, which border both countries, to avoid law enforcement and competing smugglers (Figure 6) (Hunter et al. 2021).

Figure 6.Routes of gold in Eastern Africa. Source: Hunter et al. 2021:30.

The smuggling of gold to North-West Uganda around the Arua hub is easy as there are hundreds of unofficial border points along the borders of Uganda with the DRC and South Sudan (Hunter et al. 2021:27). The gold from Arua is moved to Kampala, with estimates that between 50–100 kg transits through the city daily (Hunter et al. 2021). It has been observed that most gold dealings in Kampala are connected to police and military who provide protection for smugglers (Hunter et al. 2021).

Various actors are reportedly active in the Kampala and Entebbe gold markets in Uganda, including local dealers, foreign corporate dealers, and refineries (Hunter et al. 2021). Considering that Kampala has refineries with high capacity, these actors are thought to be the key nodes in the regional illicit gold flows that connect mines with international transit and destination hubs (Hunter et al. 2021:33). The general problem with refineries in East and Central Africa, which makes them prone to illicit gold flows, is that they hardly pass or undergo independent audits on conflict minerals in line with relevant due diligence standards (Lezhnev and Swamy 2020:6). These practices make refineries vulnerable to harassment by law enforcement officials. Thus, they are frequently targeted by political actors and criminal networks (Hunter et al. 2021).

In order to leave the country via the Entebbe airport in Uganda, smuggling is facilitated by high-ranking government and military officials; gold is typically smuggled as hand luggage or as cargo (Mthembu-Salter 2015; Hunter 2019; Hunter et al. 2021:33).

An example implicating Cavichi SARL, a Bukavu-based licensed exporter in operation between 2013 and 2016, illustrates the smuggling process from the DRC to Rwanda, another key route in illicit gold flows in the region. The firm smuggled gold via 69 shipments during the period 2015–2016, worth approximately US$190 million, while the officially-declared value was less than US$14 million. This suggests that the firm undervalued the gold with the Rwandan authorities (Impact 2020). Once the cargoes were smuggled from Bukavu to Rwanda, representatives of Cavichi SARL would use falsified documentation allegedly issued by the DRC authorities to transit through Kigali and then to Dubai, where the firm Cavichi Jewellery LLC was based. Following the report of the UN Panel of Experts on the Democratic Republic of Congo in 2016, which accused Cavichi of smuggling activities, the DRC government suspended its activities (Impact 2020:20-21; UN Group of Experts 2016).

In Kenya, the gold is typically purchased at the mine site and then moved to the capital, Nairobi, or directly smuggled to Uganda and Tanzania (Hunter et al. 2021). The trends in Kenya have changed, as presently it is more common for gold to be smuggled out of the country than in previous years. Although gold flows in both directions – Kenya-Uganda and Kenya-Tanzania –flows from Kenya have increased (Hunter et al 2021).

Actors of illicit gold flows in Kenya

Hunter et al (2021) note that Eastleigh is Nairobi’s main golden hub and the market is mainly illicit and facilitated by widespread corruption. There are reports of law enforcement officials being involved in extortion rackets, while gold dealers reported having to pay police officers and local administrators for protection. After a crackdown on illegal mining in the Migori area, it was discovered that both mines and processing plants were owned by local government officials, a former Kenyan ambassador and several Chinese investors and businesspeople (Hunter et al. 2021:40).

Actors implicated in illicit gold flows in South Sudan

Competition to capture the natural resource sector in South Sudan has turned local leaders against the government, with the involvement of international and local stakeholders. Rampant corruption from other sectors spread to gold as well (Enough Team 2020). As occurs in other countries in the region, local buyers purchase gold at mining sites and then sell it to bigger players in regional cities, typically Kapoeta and Yei (Hunter et al. 2021). Much of Kapoeta’s gold is exported illegally into the international supply chains (Enough Team 2020:5). From Kapoeta and Yei, the gold is carried by dealers to the capital, Juba, or across the border to Uganda or Kenya. Big players in South Sudan’s illicit gold trade include criminal networks connected to political actors and foreigners. Reports suggest that most of the gold produced in South Sudan is illegally smuggled out of the country. For example, a substantial amount is smuggled to Kampala via the Nimule border crossing (Hunter et al. 2021:31). Buyers reportedly comprise government officials, senior army officials and businesspeople based in Juba (Hunter et al. 2021).

Earlier studies have documented that gold from Kapoeta flows via networks of government officials and international mining interests, which has led to the militarisation of the gold trade (Enough Team 2020; Lezhnev 2021). The illicit gold trade in Juba implicates a variety of actors, including Chinese nationals, and political and business elites. Allegedly, political elites own shops in Juba and are able to easily fly the gold out of the country (Hunter et al. 2021:31). Moreover, the role of armed actors is prominent in ASGM in the Gorom area, as evidence suggests that senior army officials are involved in gold trade as buyers and providers of transportation (Hunter et al. 2021).

Contextual factors influence which actors dominate the illicit gold supply chains. In Uganda, for example, the lack of computerised cadastre systems contributes to the capture of land and mining rights by political elites, using either corruption or force. Evidence suggests that mining licenses in Uganda are mainly owned by political elites, who then instruct police to crack down on any competing operations (Hunter et al. 2021:39). Specifically, members of the Uganda People’s Defence Force are allegedly involved in the illicit gold trade (Hunter et al. 2021).

Other forms of pressure to facilitate illicit gold flows include forcing miners and/or local buyers to sell gold to politically connected companies (Hunter et al. 2021). This particular problem is related to the quality of law enforcement. Evidence from Uganda suggests that police commanders in some districts are controlled by top officials who instruct them to provide security for illicit mining and the movement of gold (Hunter et al. 2021).

Further, reports from South Sudan suggest that unlicensed mechanisation is used for gold mining. Even though the Ministry of Mining is the only authority responsible for issuing these licenses, reports suggest that it has also been done by local administrators in Kapoeta, through direct negotiations with foreign companies, in this way acting as gatekeepers for issuing licenses (Hunter et al. 2021:41; UN Group of Experts 2019b).

Regional hubs in illicit gold flows from Central and East Africa: The case of the UAE

In a study by Blore (2015), it was found that the UAE is the main destination for smuggled gold from the ICGLR region, with Dubai being the primary destination for officially-exported artisanal and small-scale gold from Central and East Africa (Lezhnev and Swamy 2020). In 2016, the UAE imported over 971 tons of gold worth around US$32 billion, of which almost half was deemed as coming from red-flagged sources (Blore and Hunter 2020:38). Lezhnev and Swamy (2020:7) argue that most of the gold from Central and East Africa enters the UAE in one of three ways.

- When the gold is exported from countries that comprise neighbouring conflict zones, such as Rwanda and Kenya, it is typically exported to refineries based in the UAE in the form of bars, or as doré in the Dubai Gold Souk.

- If the gold is from producing countries, gold doré is typically smuggled to a neighbouring country and then flown to Dubai and hand-carried to the souk.

- Sudan, they argue, is an exception as it has a refinery, so it can export gold bars to the UAE refiners directly.

The gold intended for the UAE is mostly transported by air, and most of it is brought in by individual couriers, carrying between 2–20 kilograms (Blore 2015; Blore and Hunter 2020:41; Hunter 2019). Evidence from interviews with couriers who carry gold from Bunia in the DRC to Entebbe in Uganda and then to Dubai, suggests that couriers’ bosses deal with officials at a higher level to ensure that gold can pass through airport security at the exporting point (Blore and Hunter 2020). Once they arrive in the UAE, couriers declare their gold to customs, signing a gold import form, and provide an unverified self-report on the country of origin of the gold. They are then free to sell it anywhere in the UAE, but they mostly do so in the Dubai Gold Souk (Blore and Hunter 2020:43).

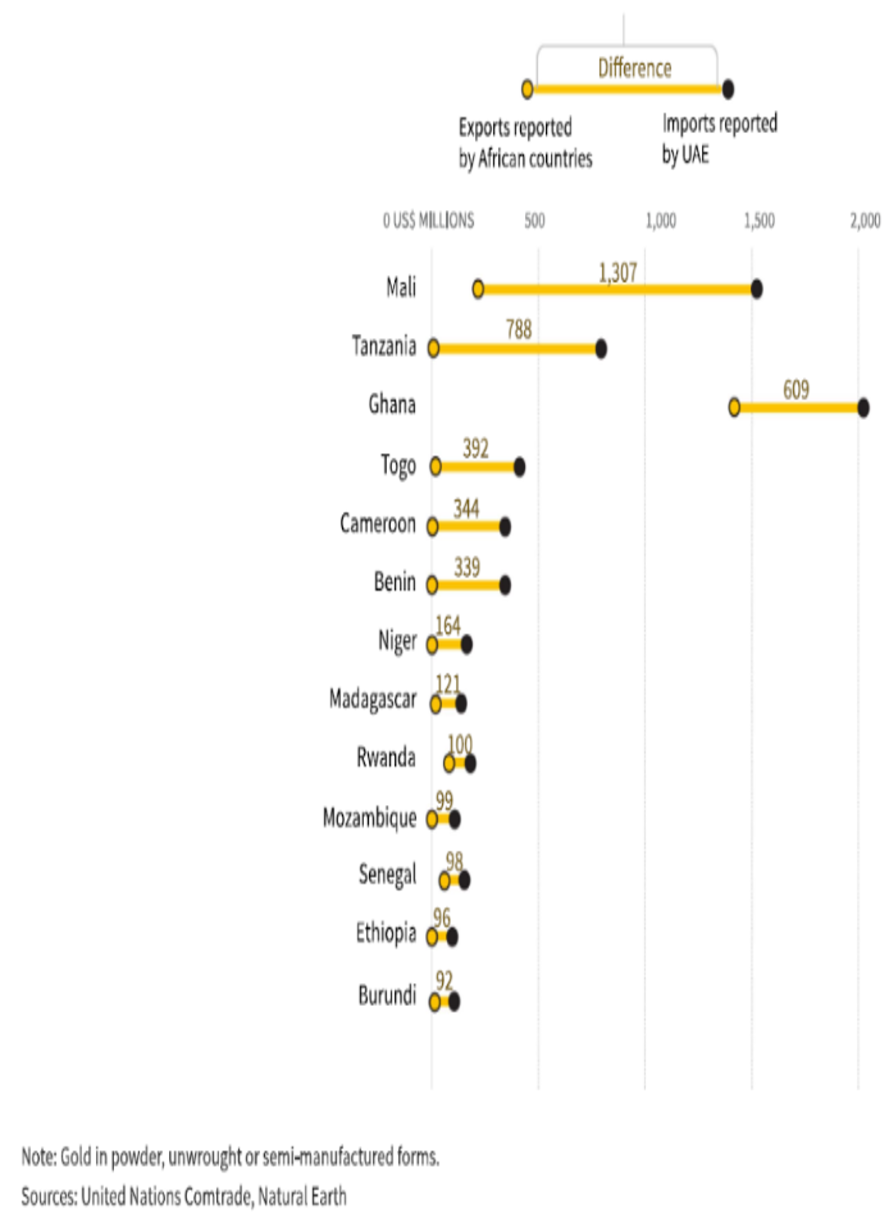

A study by Reuters found that the UAE imported gold from 46 African countries in 2016 (As cited in Lewis et al. 2019). Twenty-five of these African countries did not provide their gold export data to the UN Comtrade database. c38480455aa0 A comparison of the official export data from the remaining 21 countries and the official import data of the UAE (see Figure 7) shows that the UAE imported much more gold from these countries than reported in their exports (Lewis et al. 2019). For example, with regards to Central and East Africa, significant discrepancies exist in the cases of Tanzania, Rwanda, and Burundi. This likely suggests that a sizeable portion of this gold is illicit, although not all discrepancies point to smuggling.82a46665ca1b

Figure 7. Differences in reported exports by selected African countries and reported imports by the UAE. Source: Lewis et al. 2019.

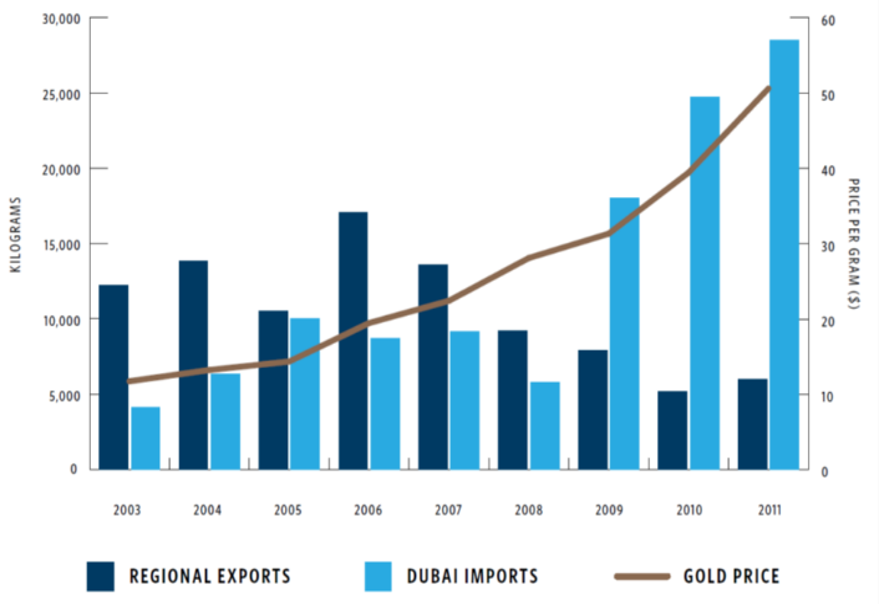

Between 2003 and 2011, gold imports to the UAE increased from 4 tons to over 28 tons. As Figure 8 illustrates, there was a decline in gold exports from the ICGLR region since 2006, while there was a huge increase in Dubai imports, particularly since 2009 (Blore 2015; Blore and Hunter 2020:44). The difference between the blue and dark blue bars in diagram below may be attributed to illicit gold flows (Blore and Hunter 2020).

Figure 8.Regional exports from Africa and Dubai imports between 2003 and 2011. Source: Blore and Hunter 2020:44.

Several factors related to regulatory frameworks in various jurisdictions are thought to facilitate illicit gold flows to the UAE. Lezhnev and Swamy (2020:7-8) identified the following risk factors:

- weak customs controls for hand-carried gold from Central and East Africa (customs rarely asks for documents to verify the legality and origin of gold, which makes misrepresenting the origin of gold relatively easy);

- inadequate oversight over gold souks (gold souks are the main destination for conflict gold from Central and East Africa. However, government controls and due diligence procedures are weak in the souks and are rarely enforced (see also Martin and Taylor 2014));

- large cash transactions, which make tracing the gold practically impossible (cash transactions largely take place in gold souks, but occasionally also in large refineries); and

- poor oversight of refiners (eg no independent audits on conflict minerals).

In 2002, the UAE set up the Dubai Multi Commodities Centre (DMCC), a quasi-private regulatory body for precious metals and gems (Blore and Hunter 2020). However, this body suffers from an inherent conflict of interest, as it is in charge of both regulating the sector and promoting trade (Blore and Hunter 2020).

In 2012, the DMCC established the Dubai Good Delivery (DGD) standard, and the DMCC Rules for Risk-Based Due Diligence for Gold and Precious Metals (DMCC Rules for RBD-GPM) in 2016. These standards were supposed to bring the DMCC in line with international standards and principles recognised in OECDc9ae74072bc3 Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (2016). For instance, the DGD standard includes requirements for the responsible sourcing of gold in line with the DMCC rules, and periodic audits for refineries (Blore and Hunter 2020:39-40).

Although the DMCC has established due diligence recommendations, these are soft measures, and thus frequently ignored (Blore and Hunter 2020). This is particularly problematic for large refineries, as most of them operate without an independent audit of their sourcing. These refineries likely buy gold through the gold souk, and most of this gold is considered to be laundered (Blore and Hunter 2020:40).

Recipient countries

From the UAE, gold is then mainly distributed to India, China, and Switzerland (Figure 9) (Interpol 2021). Testimonies of jewellers in the UAE suggest that smuggled gold tends to be absorbed by the jewellery market or exported to countries such as India (Martin and Taylor 2014).

Figure 9.Gold flows from Africa. Source: Interpol 2021:21.

Credit: Figure 9. Gold flows from Africa. Source: Interpol 2021:21.

As Blore and Hunter (2020) point out, through the reselling of ASGM gold exported from red-flagged sources to jewellers and refiners in Dubai, the UAE essentially launders illicit ASGM gold and prepares it for other global markets. For example, Switzerland imported almost 150 tons of gold doré from the UAE in 2016. In the same year, the UAE exported more than 323 tons of gold jewellery, most of which went to Iraq and India; however nearly US$500 million worth of jewellery went to the US, and almost US$700 million went to Italy, the UK and Germany – countries that do have legislation for regulating gold imports from conflict zones (Blore and Hunter 2020:38).

There are serious risks of gold being used for money laundering activities and for that gold to end up in recipient countries. For example, there is evidence that a drug network operating in Europe bought several tons of gold and sold it to a Dubai-based refinery that has close business ties to at least one gold refinery in Switzerland (Mbiyavanga 2019; Verity and Robinson 2019).

Switzerland is regarded as a high risk jurisdiction for illicit gold coming from Dubai (Mbiyavanga 2019). Swiss gold refineries are certified by the London Bullion Market Association (LBMA) – the most recognised certification programme in the refining industry. Based on LBMA guidelines, the refinery needs to suspend a business relationship if it is likely that the supplied gold is of criminal origin and/or if a supplier makes fraudulent statements about the origin of the gold. However, in practice, refineries do not engage in detailed checks on the origin of the supplied gold and rely on the self-reported statements of suppliers (Mbiyavanga 2019:5).

Harms associated with illicit gold flows

Research has identified numerous harms associated with illicit gold flows, which differ by country depending on contextual factors. Harms can be divided into the following groups: environmental harms, human rights violations, undermining the rule of law, empowering armed groups, and negative effects on countries’ economies.

Environmental harms

Illegal gold mining may have severe long-term consequences for the environment, from mercury or cyanide pollution to the destruction of flora and fauna (Interpol 2021). Mercury has long been used by small-scale gold miners in Africa to extract flecks of gold from ore, before they sluice it away (Lassen et al. 2016:72; Hunter 2018; Lewis et al. 2019). For example, in the Republic of Congo, where almost 16 kg of mercury is estimated to be released annually, gold mining is considered as the main source of pollution of water and fish (Interpol 2021:33; Kombo 2021).

Those individuals who reside near ASGM communities are likely to be exposed to methylmercury-contaminated fish or the mercury vapor that is produced during the amalgam burning process (WHO 2013; Lassen et al. 2016). Studies also found evidence of heavy metal contamination of drinking water as a consequence of illegal gold mining activities (Omotola Afolayan Oladipo et al. 2014).

The pollution has not been limited to small-scale mining activities; it has also been caused by industrial mining companies who may be responsible for cyanide spills (Lewis et al. 2019). Further, mining companies located in the vicinity of rivers may also be responsible for floods caused by spilling materials into riverbeds (Interpol 2021).

Human rights violations

Illicit gold flows have numerous negative implications for human rights. One consequence derives from conflict gold, which involves a myriad of actors with diverse motives, both political and profit-motivated, especially in the context of the ASGM sector (Hunter 2019). Gold mines in South Sudan, for example, have become conflict zones for competing armed groups. Non-violent miners may become victims in the violent takeover of gold mining areas (Hunter et al. 2021). Competition for illicit rents between competing armed groups may also result in crimes, such as murders, rape, and the burning of homes (Hunter et al. 2021). For example, in a 2019 violent clash in Gorom in South Sudan, 15 people were killed in an attack on a gold mining site, allegedly conducted by the National Salvation Front (NAS) forces who claimed that the site was occupied by the South Sudan People’s Defence Forces (SSPDF) (Hunter et al. 2021:46; UN Group of Experts 2019b).

The exploitation of labourers involved in the gold mining sector is also present, and includes migrants, who may not be aware that they are involved in illicit gold mining activities. These workers often work in inhumane conditions, sometimes spending weeks or months underground (Hunter 2019). To maximise their profits, illicit groups often resort to human trafficking. For example, in the CAR, traffickers mostly exploit nationals of Central Africa, including children (Interpol 2021). Despite being illegal, child labour is still practice din some African countries. In the DRC for example, children are known to work in mines every day, for several hours a week, and even enter tunnels to dig out gold. As a result, they are exposed to mercury, which has severe health consequences for the nervous, digestive, and immune system (Boko 2021; WHO 2013). The exposure can also damage the kidneys, heart, liver, lungs, and spleen (Lewis et al. 2019).

Further, evidence suggests that women at gold production sites are often victims of rape, sexual assault, and physical violence (Interpol 2021:35; Atim et al. 2020).

Undermining the rule of law

Gold attracts illicit money, as it has features that are attractive to criminals, such as high and predictable value, and ease of smuggling (Interpol 2021). Illicit profits may be used to purchase gold and smuggle it into formal supply chains, or be reinvested in illegal gold mining operations (Hunter 2019; Interpol 2021). Gold is also used as a currency, and evidence suggests that many deals at the border between Uganda and the DRC are made in commodities (i.e. gold is exchanged for various goods). These kinds of transactions are aimed at hampering law enforcement investigations and laundering illicit profits from criminal activities (Interpol 2021:35).

Further, cash transactions are often used to avoid screening by banks for sanctioned gold sources. For example, customers from Rwanda, Uganda, and the UAE, who buy gold from the DRC, often circumvent the banking system in order to avoid the blocking of transactions directed to DRC banks (Interpol 2021). Evidence from some parts of Africa suggests that illicit actors may sponsor local communities, by providing them services they otherwise would not receive from the state and thereby legitimising illicit actors in the eyes of local communities (Hunter 2019).

Corruption at the top levels of government has deleterious consequences for the rule of law (Blore and Hunter 2020). Political elites may use illegal profits accumulated from illicit gold flows to nurture clientelist networks that enable them to retain political power (Hunter 2019). This can result in a vicious cycle of endemic corruption (Blore and Hunter 2020). In addition, political elites benefitting from illicit gold activities may purposely block any reform processes that threaten to take away their illicit benefits (see Hellman 1998).

Evidence also suggests that entrenched political elites may attempt to influence national policies to maximise their narrow financial interests, in what resembles state and regulatory capture. This can include creating entities for regulating and profiting from ASGM, as well as direct involvement in promoting large-scale mining (Hunter 2019:20).

Empowering armed groups

Illicit gold flows from conflict zones may contribute to financing armed groups. There is evidence of illicit gold flows from the DRC to the UAE (Blore and Hunter 2020). A number of reports by the UN Group of Experts claim that ASM gold provides sustained financial benefits to DRC-based armed groups, particularly to the elements of FARDC. These benefits typically take the form of illegal taxation. There is also evidence that the armed group, the Nduma Defense of Congo-Rénové (NDC-R), was reportedly making US$35,000 per week in 2018 from controlling ASGM gold flows (Hunter 2019; UN Group of Experts 2018).

Non-state armed groups can enforce a lower price of gold in regions or markets where they have influence and control. In this way, they maximise their profits, leaving diggers and other workers at the mine site without a valuable income (Hunter 2019; Interpol 2021).

Economic effects

Due to a large volume of gold smuggling activities, countries in Central and East Africa remain without valuable resources and tax money. For instance, tax authorities in Cameroon estimated that monthly losses in 2016 from under-declaring the quantity of gold were almost US$1.8 million (Mbodiam 2016; Interpol 2021).

Further, there is evidence that politically-connected mining companies under-declare both gold production and exports in order to pay less taxes (Hunter 2019). A common tactic is to use an exploration permit as a cover to extract gold, which allegedly is the case with one politically connected company in Uganda (Hunter et al. 2021:42). It also happens that nationals illegally sell exploitation licenses to foreign companies. In Eastern Cameroon, for example, reports exist of artisanal licenses being sold to Chinese, Korean and Indian companies (Voundi et al. 2019; Interpol 2021:31).

According to the International Peace Information Service (IPIS), between 75% and 98% of gold crosses to Uganda from the DRC illegally, which robs the country ofe valuable taxes and natural resources (Dupuy and van Dijken 2019).

In some countries in Central and East Africa, there is a clear problem with illegal taxation by state services imposed on miners. For example, in Maniema province in the DRC, there is evidence of state agents controlling some pits, regularly forcing miners to work for free and profiting from the fact that these miners are not registered. Also, there is evidence that pit owners in some areas in the DRC have to pay a fee to mining state agents (Matthysen et al. 2019:48).

- Discrepancies can also occur due to declaring shipping costs and taxes differently, time-lag between cargo leaving and arriving, etc. (Lewis et al. 2019).

- See https://comtrade.un.org

- Organisation for Economic Co-operation and Development.