Query

Please provide an overview of the problem of illicit financial flows in Mozambique, including: estimated losses caused, assessment of the legal and institutional framework to prevent these flows, a comparison with aid flows into Mozambique in the last couple of years, progress made in the last years to tackle the issue (for example, efforts on asset recovery), challenges, current and future risks.

Summary

Over the past decade, the concept of illicit financial flows (IFFs) has gained traction within the international development community. According to some calculations, illicit outflows from Africa, for example, surpass the levels of development aid received by the continent, which deprives countries from resources needed to fund public services, improve infrastructure and fuel economic growth. There is, however, a lack of clarity regarding the definition of IFFs, which makes them difficult to delineate, measure and study.

This U4 Helpdesk Answer explores the issue of IFFs in Mozambique. It starts by providing some general background on the issue and its importance for development and the African continent. The second section looks at the main sources of IFFs in Mozambique, including factors such as the high levels of informal economic activity, corruption, illegal activities such as poaching and commercial practices such as trade mis-invoicing. The third section then gives a quick overview of the main regulatory and institutional framework in place to prevent the proliferation of IFFs. The final part reviews some of the main challenges that Mozambique faces in its fight against IFFs.

1. Background

The concept of illicit financial flows (IFFs) has become popular in the international development community. It is often used as an umbrella term to bring together previously disconnected issues (World Bank 2017). Although the term emerged in the 1990s and was initially associated with the notion of capital flight, it has evolved into a concept that captures the cross-border movement of capital associated with illegal activities or, as defined by Global Financial Integrity (GFI): funds crossing borders, which are illegally earned, transferred, and/or utilised (Global Financial Integrity 2015).

The existing literature on IFFs suggests that these flows generally stem from

- money laundering

- bribery by international companies

- tax evasion

- trade mis-pricing/mis-invoicing

But these categories say little about the actual origin of the flows. According to Global Financial Integrity, however, IFFs are often linked to illegal acts (e.g. corruption, tax evasion) and criminal activities (e.g. smuggling and trafficking in minerals, wildlife, drugs, people, etc.). They also include funds obtained through legal activities, but that are then illegally transferred or used for illegal purposes (e.g. financing of organised crime or terrorism). In practice, IFFs range from something as simple as a private individual transferring money into private accounts abroad without paying taxes, to highly complex schemes involving criminal networks that set up multi-layered and multi-jurisdictional structures to hide the ownership and origin of the funds (OECD 2014).

It is worth noting that even though the GFI definition cited above is the most commonly used and cited one, the concept of IFFs is continuously evolving and, as a result, there is still no agreement on a precise definition (World Bank 2017). The Organisation for Economic Co-operation and Development (OECD), for example, defines IFF as any financial flow “generated by methods, practices and crimes aiming to transfer financial capital out of a country in contravention of national or international laws”.

Many other organisations provide definitions similar or identical to the ones mentioned above, and while they might appear relatively similar, there are important differences between them which make the concept of IFFs a difficult one to grasp. Contrasting the GFI and the OECD definition, Eriksson (2017) finds some important differences:

First, the definitions disagree on which type of transfers can be qualified as IFFs: the GFI definition refers to funds, meaning money. The OECD definition, on the other hand, refers to financial capital, which is a broad term that can cover loans, equity or financial instruments, among others.

Second, neither definition is clear on which components need to be illegal for a financial flow to be considered an IFF: the OECD definition is much narrower than GFI’s in terms of where the financial capital must come from and states that the activities must be “aiming to transfer financial capital out of a country”, but activities that lack that aim do not qualify as a source for IFF under the OECD definition. Moreover, for activities that are not criminal, there is no clear requirement for illegality.

Third, the definitions disagree on whether the use of the funds matter: the OECD definition does not mention that financial capital transferred across borders can qualify as IFF based on how it is used. This difference matters because it has important practical implications. On the one hand, if the manner in which transferred funds are used is considered important, it is necessary to identify what cross-border transfers end up being used illegally in order to estimate the volume of IFFs. On the other hand, if this is not deemed relevant, the extra hurdle of collecting data on cross-border transferred funds used for illegal purposes would not be necessary.

Finally, the definitions do not agree on the legal framework that needs to be used to determine whether transfer is legal or not: unlike the OECD, which mentions “national or international laws”, GFI does not state which legal framework must be considered when determining whether a transfer of funds or financial capital is deemed illegal. At the same time, it is unclear whether the OECD definition makes reference to international legal commitments that the country has ratified, or whether illegality should be understood as a universal norm, which would make national ratification irrelevant.

The debate presented above might appear highly theoretical, but the uncertainty surrounding the definition of IFFs has important practical implications. As explained by Eriksson (2017), different interpretations can lead to very different outcomes. Taking GFI’s definition as an example, if one considers that IFFs occur only when both the source and the transfer mechanism are illegal, then a criminal’s transfer of ill-gotten gains to another country would not be considered as IFFs unless he or she uses illegal mechanisms to transfer the money out of the country. As a consequence, a country applying this definition would most likely fight against IFFs by preventing underlying illegal activities, crimes and illegal transfer mechanisms, i.e. it would not need to focus on legal transfer mechanisms. If IFFs are instead defined as such when either the source or the transfer mechanism is illegal, then policies to fight these flows would have to focus not only on preventing illegal activities and transfers, but also on detecting cross-border transfers of ill-gotten gains through legal means (Eriksson 2017).

Another criticism to the concept of IFFs is that the term “illicit”, as defined by the Oxford Dictionary, encompasses the notion that “things are forbidden or disapproved of by custom or society”. In this particular context, this suggests that some cross-border flows may be a problem even if they are not technically illegal. For instance, if a kleptocrat follows the legal process to create a law that gives him or her access to the public coffer, there is still an abuse of political position. However, a formal conviction in a court of law would be impossible, which means assets cannot be recovered through legal means. Still, despite the inclusion of the word “illicit” in IFF, the current definitions are clear: flows of public resources that are legally extracted for the benefit of private or particularistic group interests by a government do not qualify as IFFs.

Impact of IFFs on development

Despite the conceptual issues outlined above, several international organisations see IFFs as an obstacle to development. According to the OECD, for example, the most immediate impact of IFFs is a reduction in domestic expenditure and investment (both public and private). This means “fewer hospitals and schools, fewer police officers on the street, fewer roads and bridges” (OECD 2014: 15). For this reason, reducing IFFs has become a central issue in the international development agenda: The Addis Ababa Action Agenda, adopted in July 2015, for example, commits all nations to “redouble efforts to substantially reduce illicit financial flows by 2030, with a view to eventually eliminating them” (United Nations 2015). Furthermore, the United Nations’ (UN) Sustainable Development Goals (SDGs) included in Goal 16.4 the commitment to “significantly reduce illicit financial and arms flows, strengthen the recovery and return of stolen assets and combat all forms of organised crime” by 2030 (UNODC 2015).

In general, the case against IFFs tends to rest on two main arguments. First, since IFFs are mostly hidden and may come from illegal activities, governments cannot tax them. This, in turn, reduces potential government revenues that could be used for the benefit of the overall economy through either saving, investment or consumption. Second, since IFFs travel abroad they cannot benefit the society where they originated (Eriksson 2017).

These two arguments, however, rely on assumptions that may not always hold. Without further evidence, it is hard to know “whether the use of IFFs benefits development in the country of destination or if the government in the country of origin would do a better job of spending those funds” (Eriksson 2017). The assumption that an increase in tax collection would be directly linked to better development outcomes seems far-fetched, especially in countries with high levels of corruption, given that, as explained by Mungiu-Pippidi (2016), these resources are likely to be allocated according to personal connections and not to areas of the economy that would maximise benefit.

Finally, it is worth noting that “there is currently no single tool or process capable of effectively measuring or estimating IFFs” (IATF 2016). This is partly due to the conceptual constraints outlined in the previous section. The lack of a definition makes it hard for such flows to be transparently or systematically recorded in a coordinated fashion. Estimates have been made in the following areas: proceeds of crime, stolen assets, goods trade mis-invoicing, transfer mis-pricing, and undeclared offshore wealth. There are a few methods that are currently used to estimate some of these components or channels of flows (for an overview of the different methods to measure IFFs, see Fontana 2010) but they do not provide a global picture of the full scope of IFFs, and the data sources are generally not robust enough for measuring changes or determining trends across years (IATF 2016).

Extent of the problem and significance for Africa

Global estimates indicate that IFFs are substantial and growing. Even though these flows, as explained above, are inherently difficult to measure, there is widespread agreement that that the amounts involved are significant (World Bank 2017). GFI’s report “Illicit Financial Flows to and from Developing Countries: 2005-2014”, estimates that IFFs remain persistently high and account for 14% to 24% of the value of total trade from developing countries. This translates into an estimated range for total IFFs of US$2 trillion to US$3.5 trillion in 2014. Estimated illicit outflows from developing countries to the advanced economies added up to US$620 billion in 2014 (in the most conservative calculation), and illicit inflows from the advanced economies into the developing world totalled more than $2.5 trillion (Global Financial Integrity 2017).

According to GFI data, illicit outflows continue to vary across geographical regions, but the estimated level of illicit outflows continues to be largest in Asia, where they reached an estimated total value ranging between US$272 billion and US$388 billion dollars in 2014. Africa, on the other hand, has the lowest estimated level of outflows in absolute terms with an estimated range of outflows of US$36 billion to $69 billion in 2014. When compared to the volume of illicit outflows registered in Asia, the African figures might appear small or irrelevant, but once the size of the economies is taken into account, the true magnitude of the issue for Africa becomes clear: when measured as a share of total trade, illicit outflows from Africa account for 5.3% to 9.9% of total trade in the region. In Asia, however, this figure represents only between 3.9% and 5.6% of total trade (Global Financial Integrity 2017). Another telling figure is that official development aid (ODA) for Africa in 2014 amounted to US$54.2 billion dollars (OECD 2016), which means that the continent could be losing more money through illicit outflows than it is receiving in development aid.

2. IFFs in Mozambique: the problem in perspective

According to GFI’s estimations, between 2005 and 2014, an average of US$138 million to $289 million dollars left Mozambique as IFFs. This is equivalent to:

- around 1% of the country’s total trade (GFI 2017)

- between 7% and 15% of the total aid inflows to the country (OECD 2016, own calculations)

- around 10% of the government’s total revenue (Baker, Clough, War et al. 2014)

Mozambique's Attorney General's Office (PGR) has also estimated that the fraudulent use of the financial system to conceal or disguise IFFs cost the Mozambican state US$26.4 million in 2016 alone (APA News 2017).

Even though Mozambique is not a regional financial centre, money laundering is reported to be fairly common and is linked principally to narcotics trafficking and criminal kidnapping networks as well as customs fraud (US Department of State 2014). Authorities believe the proceeds from these illicit activities have helped finance commercial real estate developments, particularly in the capital. While money laundering in the banking sector is cited as a serious problem, foreign currency exchange houses, cash couriers and hawaladars play more significant roles in financial crimes and money laundering. For instance, much of the laundering is believed to be happening behind the scenes at foreign currency exchange houses, and the number of exchange houses operating in Mozambique surpasses the number required to satisfy legitimate demand. Black markets for smuggled goods and informal financial services are widespread, dwarfing the formal retail sector in most parts of the country (US Department of State 2014).

Main sources of IFFs in Mozambique

1) The informal economy

According to Mozambique’s Attorney General Beatriz Buchili, the country continues to deal with “fraudulent schemes involving circulation of large sums of money outside the financial system” (APA News 2017). The problem of informality is common across the region. According to the International Labour Organization, “the percentage of the informal economy ranges between 45% and 90%” in Africa. Mozambique, however, is among the countries with the highest rates of informality: approximately 80% of the people are informally employed in the agricultural sector or work in informal trade in cities (US Department of State 2017). These activities contribute more than 60% to the country’s gross domestic product.

As with many African countries, the informal economy in Mozambique is diverse and encompasses:

- street trading; roadside trading (prevalent in rural areas)

- home production of goods and services

- informal workers (employed in informal businesses and by unregulated labour brokers)

- informal and unregulated transport of goods and passengers (both by road and artisanal shipping)

There is also illegal trading of goods, but the divisions between formality and informality are not always absolute. As explained by Dibben, Wood and Williams (2015): “formal workplaces may choose not to declare some of their workers to the authorities, or may fail to comply with certain labour regulations. Moreover, the formal and informal sectors may also work closely together to bring costs down and distance the formal sector from any transgression of the law. An example of this is the relationship between the often illegal woodcutters and charcoal burners of northern rural Mozambique, local brokers and, ultimately, charcoal processers and packers for export markets”.

As discussed earlier, the lack of clarity in the conceptual definition of IFFs is problematic for an economy where informality is as prevalent as in Mozambique: since a large part of the economic activity occurs outside of the law, a large volume of transactions could be labelled as IFFs despite them not being of a criminal nature. The low levels of financial inclusion in the country mean that many transactions occur in cash, leaving thus no paper-trail and making them virtually impossible to track, control or tax (IMF 2018). Due to these difficulties, this Expert Answer will focus almost exclusively on IFFs originating from illegal sources.

2) Corruption

Corruption is seen as a pervasive problem in Mozambique. The latest edition of Transparency International’s Corruption Perceptions Index gives the country a score of 25 on a scale from 0 (most corrupt) to 100 (least corrupt). The country also fares poorly on all six dimensions of governance measured by the World Bank’s Worldwide Governance Indicators (WGI), and has been progressively deteriorating (Wolf and Klein 2016). A recent estimate of the cost of corruption to Mozambique in the period from 2002 to 2014 put it at a staggering US$4.9 billion (Centro de Integridade Pública & Chr. Michelsen Institute 2016).

Corruption can be both a source and a driver of IFFs. While direct proceeds of corruption, such as bribes and embezzlement of state funds are thought to constitute just 5% of illicit outflows (Goga 2015), corruption can be considered an important enabler of IFFs. By bribing the public to stop them from conducting certain activities or using political connections for the same purpose, the systems put in place to track, monitor, investigate, prosecute and sanction illegal or criminal activities that result in IFFs may be easily distorted.

The high levels of corruption in Mozambique can create fertile ground for IFFs. In 2016, for example, a scandal came to light which involved undisclosed loans of US$ 1.4 billion. These loans provided by Credit Suisse and the Russian bank VTB went to three companies controlled by the state security services (SISE). A recent audit financed by the Swedish government attempted to identify how the loans were spent, but was unable to fully do so given a partial lack of cooperation with the audit in Mozambique. According to De Renzio and Nuvunga (2016), some of the loans were intended as “kickbacks” for personal enrichment and political patronage rather than their stated purpose. Moreover, the loans dispersed to the three state-owned enterprises were illegally issued government guarantees by Minister of Finance Chang, who required parliamentary approval (Williams and Isaksen 2016).

This particular case is seen as a clear example of how corruption can breed IFFs given that “the process surrounding the state’s backing of private debts owed to foreign creditors was domestically unconstitutional and that, in addition, the loans broke a domestic budget appropriation bill as well as rules in foreign financial services jurisdictions” (Williams and Isaksen 2016: 1).

3) Trade mis-invoicing

Trade mis-invoicing refers to the intentional misstating of the value, quantity, or composition of goods on customs declaration forms and invoices, usually for the purpose of evading taxes or laundering money:

- Traders can under-report the amount of imports in a transaction to circumvent applicable tariffs and VAT.

- Import over-invoicing disguises the movement of capital out of a country. This could be a work-around for capital controls, and a company may be able to subtract that input value from its year-end revenue report to the government, which would lower the amount of taxes it owes to the government.

- Export under-invoicing involves under–reporting the amount of exports leaving a country in order to evade or avoid taxes on corporate profits in the country of export by having the difference in value deposited into a foreign account.

- Export over-invoicing involves over-stating the amount of exports leaving a country, which often allows the seller to reap extra export credits. Companies or individuals may also use this form of trade mis-invoicing to disguise inflows of capital to avoid capital controls or anti-money laundering scrutiny.

According to GFI estimates, cumulative gross illicit flows from trade mis-invoicing in Mozambique amounted to US$5.27 billion over the nine-year period 2002 to 2010. Average annual illicit flows were US$585 million, and both export under-invoicing and import over-invoicing seem to occur in roughly equivalent amounts (Baker, Clough, Kar et al. 2014).

4) The extractive sector

Mozambique’s recent record of economic success has been largely driven by extractive industries, particularly forestry and coal mining, as well as the exploitation of large natural gas reserves off the northern coast, discovered in 2012. Some evidence suggests, however, that extractive sectors can easily become breeding grounds for IFFs.

As explained by Le Billon (2011), the close connection between the abundance of natural resources and IFFs is due to some of the intrinsic characteristics of the extractive industry. According to this author, the extractive sector is particularly prone to IFFs for the following reasons:

- extractive industries fall under high-level discretionary political control, such as a president or executive committee, and are often prone to secrecy

- state companies in extractive sectors often blur lines between personal and public interests

- limited competition in extractive sectors leads to fewer corporate checks and balances

- extractive sectors often require high degrees of technical expertise which facilitate the falsification of reports

Despite the academic considerations and anecdotal evidence suggesting that the extractive sector is particularly prone to practices such as embezzlement, theft, tax evasion and trade mis-invoicing, there are currently no estimates of the proportion of IFFs that stem from the extractive sector (Martinez B. Kukutschka 2017).

According to the Environmental Investigation Agency (EIA), around 76% of Mozambique’s timber exports in 2013 were illegally cut in excess of reported harvests. According to some estimations, this has deprived the country of US$146 million in tax revenues since 2007 (Environmental Investigation Agency 2014). The illegal logging is often attributed to widespread corruption and poor governance (EIA 2013). Evidence shows that bribery and fraud among public officials and timber agents have facilitated illegal logging; high-level "friendships" between the public officials and the timber agents help the agents avoid regulations and illegally obtain logging permits (EIA 2013).

Mozambique became an EITI compliant country in October 2012. This represents an important step towards more transparency in the extraction, use and allocation of revenues from the oil, gas and mining industries. For this initiative to have an impact against IFFs, however, it is important that the data collected through the EITI process in Mozambique is used not only to follow the path of government revenue, but also to determine whether the government is collecting an appropriate amount of revenue from companies involved in extracting non-renewable natural resources.

5) Poaching and smuggling

According to UNODC (2017), wildlife crime in recent years has grown into a significant and specialised area of transnational organised crime, driven by “high demand and facilitated by a lack of effective law enforcement and low prioritisation as a serious crime, weak legislation, and non-commensurate penalties”. It is a highly lucrative illicit trade, with wildlife products commanding high prices on the illicit market, and global proceeds estimated to amount to between US$7 billion and 23 billion annually and is thus a driver of money laundering and IFFs.

Poaching operations in Africa have grown increasingly sophisticated with injections of large amounts of cash from foreign ivory traffickers resulting in professionalised ivory poaching gangs armed with high-powered hunting rifles and AK-47s. As a result of poaching, elephant populations have crashed over the past decade. The elephant population in the Niassa National Reserve, for example, has declined from an estimated 12,000 in 2011 to just 3,675 in 2016.

No data was found on the estimated value or volume of illegal elephant tusks and rhino horn trade in Mozambique, but reports have been published on signs of wealth appearing in the poor Massingir district of Mozambique, such as large houses and expensive cars, with anecdotal evidence that these are financed through rhino poaching in the adjacent Kruger National Park in South Africa (Oxpeckers 2017).

3. Legal and institutional frameworks against IFFs in Mozambique

As explained earlier, IFFs stem from corruption, crime, terrorism, and tax evasion and the channels through which they are transferred from one country to another can range in sophistication from cash smuggling and remittance transfers, to trade finance and shell companies. Because of the complex nature of the phenomenon and its cross-sectoral nature of IFFs, a wide range of policies and actions are needed to combat them. According to the World Bank (see Badré 2015), efforts to curb IFFs should aim to:

- address their direct sources by reducing criminal activity, corruption and tax evasion

- preventing illegal money from leaving the country

- stopping financial intermediaries and other service providers from accepting those assets

To achieve this, countries need to adopt and enforce policies that promote good governance, tackle corruption, go after dirty money and implement transparent tax systems. According to Reuter (2017), there are five main interventions explicitly aimed to reduce IFFs:

- Anti-money laundering (AML) laws and programmes: these laws have a dual purpose and aim to prevent offenders from turning illegally generated money into legal funds that can be used for any investment or consumption purpose and using the effort to launder moneys to apprehend and punish offenders, including those professionals who help the primary offenders move, conceal or transform the proceeds of crime.

- Stolen asset and recovery procedures: asset recovery involves tracing, freezing, confiscating and returning to the country of origin, funds obtained through illegal means, and usually involves lengthy and politically complex processes. These laws and programmes seek to facilitate the return of assets stolen from national coffers to their countries of origin.

- Automatic exchange of information between countries: under these agreements, each country’s banks are required to provide the other country with information about accounts held by that country’s residents.

- The development of new rules regarding country-by-country reporting of corporate profits, intended to prevent corporate profit-shifting abuses.

- The development of beneficial ownership registries, which would ensure that ownership of financial assets, and a broad array of real assets, could not be hidden.

Legal framework

Mozambique has a legal anti-corruption framework in place but struggles with its effective implementation. Most high-level political and economic elites are often immune from prosecution (HRR 2015). The Anti-Corruption Law criminalises extortion, kickbacks, attempted corruption, as well as active and passive bribery in the public sector. However, the law does not cover other forms of corruption such as embezzlement (BTI 2016).

Regarding its AML legislation, the country was last assessed against the Financial Action Task Force’s (FATF) standard in September 2011. In its mutual evaluation report, the country was found not compliant with any of the 40+9 FATF recommendations, and largely compliant with only one. As a consequence, it was placed – and remains – under enhanced follow-up (IMF 2018). Some of the main concerns included: i) inadequate AML/CFT supervision of financial institutions; ii) lack of effective supervision of designated non-financial businesses and professions; and iii) lack of enforceable requirements for financial institutions to identify politically exposed persons (PEPs).

In 2013, the government of Mozambique introduced a new anti-money laundering law to comply with the revised standards issued by the FATF. Article 4 of the Law on Capital Laundering (Law 14/2013) explicitly prohibits the conversion or transfer of property or any attempt to disguise or conceal its illicit origin, true nature, source, location, acquisition, possession or use of the property knowing that it is the proceeds of crime. Article 7 includes in its list of related crimes criminal association, which is dealt with independently of the main crime of capital laundering. Although this law is the foundation for deterring the laundering of the proceeds of crime and introduces important reforms, the promulgation of regulations that will allow its full implementation is still pending.

In terms of other relevant legislation that could potentially help detect IFFs:

- The Witness and Protection Act allows for the protection of whistleblowers and introduces a witness protection programme that also provides for a new identity and relocation for witnesses.

- The law on asset disclosure makes it compulsory for all government members, as well as their spouses and legal dependents, to disclose their assets, and any breach would engender fines. Compliance is, however, deemed limited and information on declarations is not made public (US State Department 2015).

Overall, Mozambique is seen to have a generally adequate legal framework to prevent money laundering, but the country “must take important strides to achieve an acceptable level of effectiveness” (IMF 2018). This would imply:

- improving the supervision of financial institutions as well as implementing enforceable requirements to identify politically exposed persons

- increased transparency of the beneficial ownership of corporate vehicles

- formulation of an appropriate legal framework on asset recovery and mutual legal assistance (IMF 2018)

Institutional framework

Organisations responsible for enforcing the law have serious capacity constraints. The judiciary’s budget is set by the executive, which reduces its autonomy. The police lack basic working conditions such as remuneration, equipment and staff. Overall, as the institutions responsible for enforcing the law are not autonomous this reduces considerably the effectiveness of anti-bribery legislation. Recent legislation clearly prohibits the bribery of public officials, in the private sector and involving expatriates.

Central Anti-Corruption Office

Established in 2005 via decree, this entity is responsible for the prevention and criminalisation of corruption. Under the 2012 anti-corruption package, through the Law on the Office of Public Prosecutions, it was placed under the supervision of the Public Prosecutors Office (PGR), and mandated to investigate and prosecute corruption.

Central Public Ethics Commission (GCCC)

Created by the Law on Public Probity, the central commission coordinates the work carried out by local public ethics commissions. It is mandated to establish norms, procedures and mechanisms, to avoid or prevent potential conflicts of interest. It is made up of nine members, elected for a three-year term with the possibility of re-election for one additional term. There are also 77 sectoral commissions spread around the country, which report to the GCCC.

Reception and Verification Committee (RVC)

Article 63 of the Law on Public Probity established the responsibility of the PGR to evaluate, verify and investigate issues arising from asset disclosures of public officials. A committee was established within the PGR to coordinate from Maputo, and to receive, verify and investigate asset disclosures from Maputo. There are in total 12 provincial committees (including the committee in Maputo), with five members each. There is a representative from the PGR in each of the provincial committees.

Financial Intelligence Unit (GIFIM)

GIFIM was created in 2008 to collect, centralise, analyse and disseminate information to law enforcement agencies on potential cases of money laundering. It is staffed with 18 people, eight of whom are operational. The GIFIM is responsible for investigating suspect or illicit financial transactions. Before GIFIM became operational, the attorney general’s office was responsible for handling investigations related to money laundering. In 2011, the government created a multi-sector task force, chaired by the Ministry of Finance and comprising the ministries of justice, interior, the attorney general’s office, the central bank and GIFIM.

Judiciary

Experts and citizens alike point to Mozambique’s judiciary as being a highly corrupt or, at the least, a highly inefficient institution (Wolf and Klein 2016). A weak judiciary has impeded Mozambique from enforcing anti-corruption legislation and has led to a sense of impunity for crimes related to corruption.

A previous U4 helpdesk answer on corruption and anti-corruption efforts in Mozambique gives a more thorough overview of the institutional framework in the country.

4. Challenges ahead in fight against IFFs in Mozambique

While Mozambique’s legal and institutional framework to curb corruption and potential sources of IFFs still needs some improvements, the government has taken steps to bring it closer to compliance with international standards (US Department of State 2015). Limited resources and high levels of corruption, however, hamper the government’s ability to fight money laundering and terrorism financing and to implement existing AML controls. Local institutions often lack the funding, training, and personnel necessary to investigate money laundering activities and to enforce the law. Moreover, money or value transfer services and exchange houses are heavily regulated on paper but, in practice, easily avoid reporting requirements.

The technical capacity of GIFIM, for example, is considered good by its management, with sufficient and well-trained staff. However, its role is only one part of the whole enforcement chain, which includes other agencies that may have serious weaknesses. Among these is the Investigation Unit of the Criminal Investigation Police, which lacks capacity to carry out its role. There are also considerations about GIFIM’s autonomy, currently under the Ministry of Finance and the prime minister, and it does not have the power to freeze/block bank accounts to facilitate investigations, which requires a court order.

Since 2011, however, GIFIM has received information that allowed the detection of illicit or suspect transactions. In 2013, the agency identified 34 transactions amounting to US$35 million; in 2014, it investigated 30 cases of suspect transactions totalling US$259 million, and to June 2015, GIFIM investigated cases involving US$100 million.

These figures show that GIFIM is operational and is doing its part in the money laundering legislation enforcement chain. Other institutions, including the judiciary and the police, however, are responsible for using this information for follow-up, and possibly for penalties, wherever applicable (Centro de Integridade Pública 2016).

The Natural Resource Governance Institute (NRGI) also finds that implementation is one of the main problems in natural resource management in Mozambique, a sector that, as mentioned before, can be an important source of IFFs. According to NRGI’s Resource Governance Index 2017, “there is a discrepancy of 18 points between legal frameworks and their practical implementation in Mozambique” (NRGI 2018). On one hand, the rules on tax administration and guiding audits of subnational transfers are good, but practical implementation is weak.

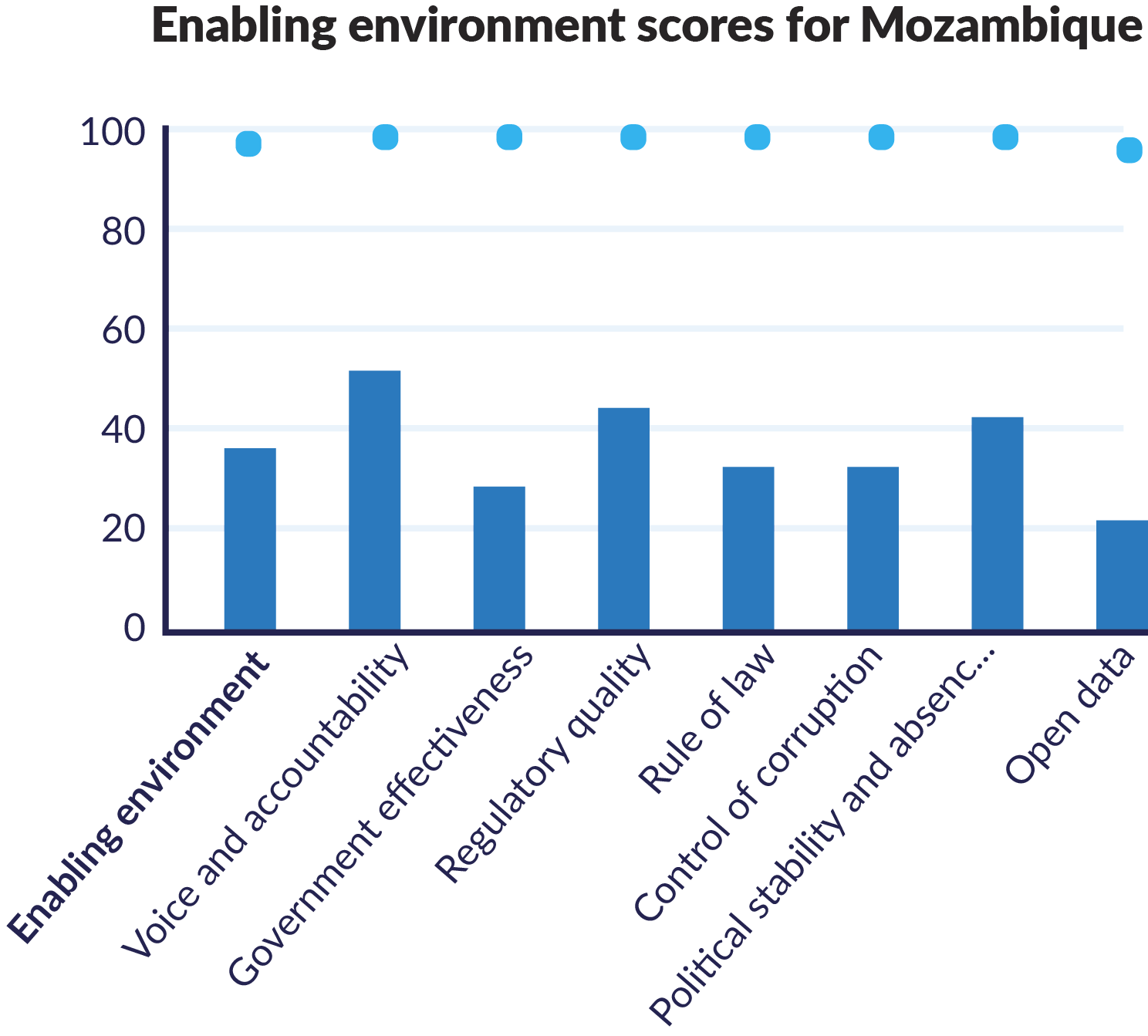

While active enforcement of the existing legal framework could help improve the country’s resource governance significantly and reduce IFFs, this is unlikely to happen given that the overall “enabling environment” is what is hindering its performance (NRGI 2018). As per NRGI’s assessment, the country “achieves failing or poor scores in four out of the seven areas related to the “enabling environment”, i.e. control of corruption, rule of law, government effectiveness and transparency/open data (see Figure 1).

Figure 1. Resource Governance Index: Enabling environment scores for Mozambique

Source: NRGI 2018

Given these poor results, an effective strategy to prevent and curb IFFs in Mozambique is likely to require a broader approach, i.e. one that strengthens governance and minimises the effect of systemic conditions. The OECD’s toolkit to combat IFFs thus recommends taking a broader approach and:

- understand the scale of domestic crime, notably proceeds-generating crime and organised crime

- assess the strength and integrity of public institutions (including law enforcement, tax authorities and financial supervisors)

- ensure good governance, rule of law and strong institutions, including the involvement of civil society and independent media

- analyse the size of the financial sector, including international and offshore financial centres as this might impact the country’s exposure to IFFs originating domestically and from other countries

- examine the role of the international environment, the impact of geographical location and cultural links as these also influence the risks of IFFs from other countries

- identify the degree of secrecy/transparency in public and private institutions, e.g. bank secrecy, transparency of beneficial ownership of legal persons and arrangements

- survey the composition of the national economy, and explore how this composition may encourage or discourage illicit flows

As a result, a strategy to curb IFFs in a context like Mozambique’s needs to focus not only on these flows themselves or on the financial sector, but on the overall enabling conditions, i.e. the factors which make an essential contribution to IFFs either as a precondition for certain measures, or as structural factors which could undermine the effectiveness of anti-IFF measures.