As countries look to accelerate their climate ambition with the hope of limiting global temperature increases to 1.5°C, many are considering how a carbon tax on greenhouse gas emissions can help achieve their goals. Bribery, embezzlement, trading in influence, and other forms of corruption can interfere with how carbon taxes are designed and implemented. In the long run, corruption – as well as the factors that enable it, such as revolving doors and conflicts of interest – can hinder how effective a carbon tax is and affect whether it is deemed legitimate by stakeholders and the broader public.

This brief discusses the main corruption risks that arise across the carbon tax policy cycle and the policy tools that can be employed to limit them. It is aimed at informing policymakers, development agencies, civil society advocates, and others involved in the design, implementation, and oversight of carbon taxes.

Table 1 summarises the actors that can be implicated in corruption, key factors that can enable corruption to take place, and the main corruption acts at each policy stage.

Table 1: Summary of corruption risks and actors across the carbon tax policy cycle

| Main policy elements | Actors | Enabling factors | Corruption acts |

| Policy development | |||

|

|

|

|

| Policy implementation | |||

|

|

|

|

Source: Own elaboration.

Corruption: A threat to effective and legitimate carbon taxes

Economists, academics and policymakers increasingly agree that a strong, stable carbon price is an important part of the policy package needed to cut emissions. The rationale is that, if polluters must pay for their emissions, they will switch to low-emissions alternatives. However, there is an important qualifier: the price must be strong, stable, and – crucially – difficult to avoid.

Carbon taxes account for the majority of carbon pricing instruments currently found in developing countries.They are an attractive choice for policymakers as they require less advanced institutional capacities compared to other policy options. While the other main form of carbon pricing – emissions trading systems – is a more complex policy mechanism requiring new infrastructure and institutions, carbon tax can often be built on the back of existing fuel taxes by basing tax liabilities on the carbon emissions associated with each fuel.

Despite its relatively simpler designs compared with emissions trading, carbon taxes raise important corruption risks. As with any policy mechanism that involves significant sums changing hands, ample incentives exist to influence how the mechanism is designed, to avoid payment obligations, and the possibility of siphoning off revenues. Corruption acts are often especially pronounced in countries with low governance capacities.

In addition to risking carbon taxes' effectiveness in reducing emissions, corruption (or the perception of corruption) makes it harder to win the public support needed for governments to adopt and maintain ambitious policies. Countries with low levels of perceived corruption have, to date, been able to adopt significantly higher carbon prices than those where corruption is perceived to be high. Addressing corruption – and being seen to address corruption – is therefore important for building the trust and support needed to adopt a strong, stable carbon tax.

Corruption risks across the policy cycle

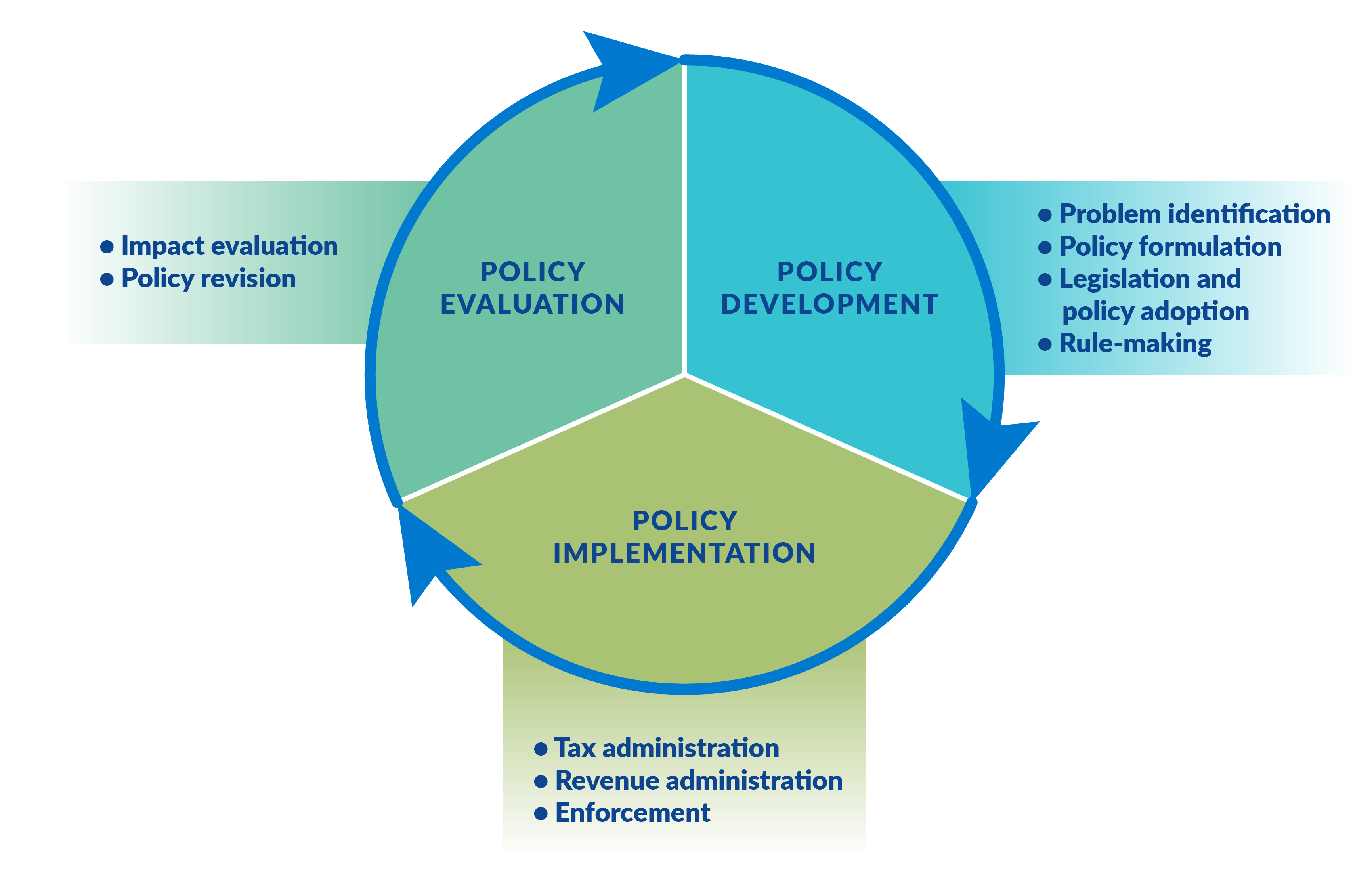

Corruption can occur at each stage of the carbon tax policy cycle. This process typically begins with policy formulation and adoption, followed by the tax being implemented (possibly after a pilot phase) and periodically evaluated and updated. The specific process varies depending on each country's laws. In some cases, stand-alone legislation may be required, while other countries may be able to adopt a carbon tax as part of their annual budget bill. Figure 1 presents the typical steps in the carbon tax policy cycle that a country may follow.

Figure 1: Carbon tax policy cycle

Source: Own elaboration.

Many corruption risks that emerge with carbon taxes also arise in similar policies. Carbon tax in countries where tax regimes and public finance administration systems are already corruption-prone will typically face higher corruption risks. Addressing these risks, especially where they stem from broader governance issues – such as low public service wages, limited transparency, and weak enforcement – often requires broader reforms beyond the scope of any one policy.

Carbon taxes also have their own particular risks, linked to how the tax instrument is designed, and no two carbon taxes are precisely the same. Recent years have seen countries become increasingly creative in developing designs adapted to their specific circumstances and needs, ranging from simple instruments closely integrated within existing fuel tax systems, to complex instruments that require new, multi-layered administration. These more complex designs often result in greater corruption risks.

Adopting, evaluating, and revising carbon taxes

Adopting a carbon tax raises complex policy questions, and countries will typically go through a significant number of steps before the tax can be adopted and implemented. While the process varies for each country, it usually begins with a government ministry identifying a problem that needs to be solved (eg, the need to meet climate mitigation targets) and assessing options to address this problem. Policy proposals will then be formulated and discussed with stakeholders, including other ministries, politicians, industry bodies and civil society.

Once the proposal is ready, it will often need to go through a legislative process to become law. This also provides opportunities for legislators to make amendments. Once legislation has been approved, government ministries will be tasked with developing the technical rules required for policy implementation. Countries will typically conduct periodic revisions of a policy, either following a scheduled evaluation, on the identification of problems in implementation, or due to changing circumstances or political factors. Following evaluation, the process is often repeated.

The various stages of the policymaking process create opportunities for corruption and undue influence on policy development. There are strong incentives for actors that would be affected by a carbon tax, such as high-emissions industries, to either block the adoption of the tax, weaken it, or otherwise limit the impact it will have on their business. In most cases, there will be legitimate avenues for these actors to participate in the policy process, including through stakeholder consultations, formal lobbying, or public communication campaigns. However, some may seek to stretch – or simply ignore – the boundaries of these legitimate avenues.

The most extreme cases of actors improperly influencing the policymaking process involve the payment of bribes in exchange for favourable policy decisions. For carbon taxes, this may involve excluding a given actor or category of participants from the scope of the tax, or granting reduced rates, tax rebates, or other concessions.

While there is limited research on bribery in the adoption of carbon tax processes, research on fossil fuel subsidy reform has indicated that countries that are able to control corruption are more capable of eliminating subsidies. This is notable since the main outcome of fossil fuel subsidy reform – increasing fossil fuel prices – is closely related to what a carbon tax seeks to achieve. Beyond fossil fuels, there is also evidence of large farmers giving bribes to politicians in exchange for subsidies, often resulting in agriculture-driven deforestation.

While bribery offers an unmistakable example of corrupt influence over policymaking processes, other cases straddle the line between legitimate lobbying and undue influence over decision-making processes. In the USA, large oil and gas firms provide hundreds of millions of dollars in political donations while also lobbying politicians to block or weaken carbon prices and other climate policies. In a significant share of cases, the ultimate sources of donations are not disclosed, making it difficult or impossible to assess potential cases of undue influence. A 2018 study indicated that policymaking in the US Environmental Protection Agency – whose then head received substantial political donations from the energy sector – had been subject to regulatory capture by business interests.

Conflict of interest in government increases the risk of undue influence taking place. Decision makers may have personal interests that conflict with their ability to act impartially in the policymaking or legislative process. While some countries have strict regulations requiring politicians to declare and avoid such conflicts of interest, other countries remain largely unregulated. Research has shown that the business interests of members of the Indonesian parliament in high-emitting industries presented a major barrier to the country's adoption of a carbon tax.dead714277c1

Even in countries where politicians are prohibited from maintaining active business interests, lobbyists or other businesspeople elected or appointed to political positions may maintain close links with industry. Often referred to as a ‘revolving door’ between business and government, these close links can result in decisions that are overly favourable to business at the expense of the common good. There are numerous instances of fossil fuel lobbyists and executives being appointed to policymaking positions with major influence over climate change policy, including the head of the US Environmental Protection Agency and UK business secretary.

Conflicts of interest are not limited to politicians. Other actors who obtain privileged positions in the policymaking process, such as government advisors, should also be expected to maintain independence. Where they fail to do so, this can impact the objectivity of their advice and result in decisions that favour particular interests over the common good. For instance, an investigation in 2017 found that several large accounting firms served on committees that advised the UK government on North Sea tax policy while also providing services to the companies that this policy is designed to regulate. According to the investigation, this allegedly created a conflict of interest for the firms involved.

Many of the corruption risks that arise in policy development can also emerge in adopting carbon tax revisions. This process will often follow similar steps, though minor revisions may be adopted through a simplified procedure.

Ideally, major revisions to the tax will be informed by an impact evaluation, which assesses the mechanism's progress in achieving its goals, and identifies areas for improvement. This process can also increase the risk of officials abusing their power. For instance, government officials may manipulate results to indicate that carbon taxes have been more successful than in reality. This has been reported in some countries in other policy areas.

Implementing a carbon tax

Implementing a carbon tax requires overseeing administration, calculating tax liabilities, and measuring, reporting, and verifying (MRV) emissions, as well as collecting revenue and ensuring compliance. Most carbon taxes have been applied to specific fuels, carried by existing excise and customs taxes on liquid or solid fuels. These are typically administered through an existing system used for determining tax obligations – through monitoring how much fuel is produced, imported, and sold. In these systems, carbon emissions are calculated by simply multiplying the amount of fuel sold by the emissions that each unit of fuel is expected to produce. Fuel distributors are responsible for collecting taxes on behalf of their customers. This results in a relatively simple and efficient system that provides fewer opportunities for corruption.

Some carbon taxes require new systems and entities to be created. When a carbon tax is introduced as a stand-alone tax category, a new tax administration and revenue collection framework is needed. And if the tax targets emissions ‘downstream’ – that is, at the point where fuel is burned rather than when it is sold – or if it targets emissions from non-fuel sources, new (and often complex) MRV systems will be required (see Box 1). Tax designs will also need new structures that incorporate flexibilities – for example, to allow companies to purchase carbon offsets instead of paying the tax.

Box 1: Measurement, reporting and verification (MRV) of emissions

MRVof emissionsis necessary for calculating the amount of carbon tax payable by each covered entity. It is therefore essential for ensuring the proper functioning of a carbon tax. While taxes that are built on top of existing fuel tax systems can measure emissions simply based on volumes of fuel sold, taxes applied directly on emitting entities (eg, factories, power plants), require more complex MRV systems. These usually require the covered entity to monitor emissions according to specific technical and legal requirements. Once a monitoring cycle (usually a year) has been concluded, the emissions must be reported to the responsible government agency. An independent review by an accredited third-party entity must be conducted to verify the veracity and accuracy of the reported data.

More complex carbon tax designs often result in higher corruption risks. In downstream carbon taxes, polluting firms typically measure and report their own emissions, and auditors verify the submitted emission reports. When not properly overseen, this creates opportunities for polluting firms to bribe auditors or other environmental inspectors to falsify or legitimise emission reports – ultimately leading to an abuse of function. This practice is observed in emissions reporting across the world, in countries such as Tunisia, Indonesia and India, as well as across Europe.7b1143b765f5

When auditors are chosen and paid by the firms they have to audit, a conflict of interest may ensue where auditors may be incentivised to overlook discrepancies to maintain business relations. This economic dependency, also observed in ISO standard certification, can undermine the independence of the auditor and, consequently, the legitimacy of the verification.

Polluting firms may also attempt to evade tax obligations by manipulating data used for measuring emissions. There are several cases of firms evading analogous environmental obligations. One of the best known examples is the Volkswagen scheme, in which software was used to cheat testing processes, thereby evading diesel emission standards. Similar issues could arise in carbon taxes that are applied to individual vehicles, as has been proposed in Costa Rica. Such cases would also create opportunities for companies or individuals to bribe vehicle inspectors responsible for determining vehicle use and emissions levels.

When polluting firms are allowed to offset part of their emissions by buying carbon offsets (see Box 2), their liability to pay carbon taxes can be reduced proportionally. However, this brings its own set of corruption risks. For example, in the case of emissions reports that are used to calculate tax obligations, auditors contracted to verify emissions reductions from these offset projects may be subject to conflicts of interest or, in extreme cases, accept outright bribes in exchange for overlooking inflated emissions reductions calculations.

Box 2: Carbon offsets

A carbon offset represents an amount of reduced, removed or avoided greenhouse gas (GHG) emission that compensates – or offsets – the same amount made elsewhere. Carbon offsets result from projects such as those that accelerate renewable energy deployment, improve energy efficiency, reduce landfill methane, and regenerate forest areas. Offsets are generated based on emissions reduced or removed relative to a baseline that represents the situation that would occur without the project. Offsets must adhere to rigorous measurement, reporting and verification (MRV) standards. A carbon tax can be designed to allow taxpayers to surrender carbon offsets as a substitute for paying their carbon tax obligations. In doing so, governments often seek to reduce costs to covered entities while incentivising emissions reductions projects, usually in sectors that are not covered by the carbon tax.

Where regulations are ambiguous, conflicting, or give a wide margin of discretion to public authorities, this can create space for fraud, which may be facilitated by corrupt behaviour. A recent investigation (June 2021) indicated that carbon project developers in Colombia exploited ambiguities in national regulations to inflate emissions reductions calculations. This allegedly enabled the developers to issue credits that were not backed by real emissions reductions. These credits were subsequently used by firms subject to the country’s carbon taxes to avoid their tax obligations. While in this case no allegations of corruption were made, cases of inflated emissions calculations create incentives for project developers to bribe auditors or public officials responsible for checking emissions calculations.

Another policy implementation risk is the misuse or embezzlement of part of the revenue generated by the carbon tax. While there is limited research on the embezzlement of carbon tax revenues, it is frequently cited as a chief concern by stakeholders in countries considering adopting carbon prices, particularly those where corruption is perceived to be high.b800b9086d4e

The nature of the risk depends on how carbon tax revenues are used and managed. In countries where carbon tax revenues are allocated to the general budget, the risk is linked to overall risks of embezzlement of public funds in the country. When revenues are set aside to be managed in a specific fund or facility, embezzlement opportunities may be created by fund managers, or project and programme managers.

A fuel price increase due to carbon taxes may create a perverse incentive for polluting firms to shift part of their operations into the shadow economy (where criminal activity takes place outside the regulatory system). There is also the chance that regulators might turn a blind eye in exchange for bribes. Trade in illegal fuel amounts to tens of billions of US dollars per year globally and is often strongly linked to corruption.

Upstream carbon taxes63daf6c3e950 can be associated with reduced tax evasion rates compared to other taxes. Therefore, governments may be able to reduce overall tax evasion by shifting taxation from corporate and labour tax to carbon tax and other environmental taxes.

Where the government engages private entities to support policy development (eg consultants) or carbon tax implementation (eg private tax collectors), there is a risk that contracts can be awarded based on cronyism, or in exchange for bribes. Research indicates that outsourcing tax collection to private entities may reduce corruption at collection level but increase opportunities for corruption at contract tendering.

Finally, corruption can prevent proper enforcement of carbon taxes and prosecution of non-compliance cases. For instance, firms may offer bribes to: tax inspectors to overlook non-compliance; prosecutors to not prosecute identified cases; or judges to pass a favourable sentence. As carbon tax enforcement is usually carried out by authorities responsible for broader tax enforcement, the risk of corruption inhibiting enforcement is closely linked to how prevalent corruption is in those countries. Laws that provide significant discretion to enforcement authorities can also provide more scope for corrupt decisions.

Policy options to mitigate corruption risks

Transparency reduces corruption risks across the carbon tax policy cycle

Transparency increases the integrity of carbon tax adoption and implementation and enables third-party monitoring of private and public compliance.

During the development of the policy, there should be a transparent record of all stakeholder engagement and lobbying activities, including which actors were involved, their role in the process, and their stated positions. This can be achieved by maintaining a database that records the content and frequency of policy consultations.

In the implementation phase, governments should ensure access to emissions reports and verification reports, as well as to records of fuel sales, tax liabilities and other data relating to tax collection and enforcement. Information should also be published on how much revenue is raised and, in cases where revenue is set aside for specific uses,9a84f4a5789e how that revenue is spent. For example, the Regional Greenhouse Gas Initiative (RGGI) – an emissions trading scheme in the USA – uses an online platform to track how revenue is being invested.

Increase and formalise participation in the policymaking process

Rules should be developed for who can participate in the policymaking process, ensuring balanced representation of affected stakeholders, civil society and the public. How the input of consulted stakeholders is considered in policymaking should also be regulated and transparently communicated to third-party observers to ensure that any abuse in functions or trade in influence is identified during the development of the policy.

Greater participation of the general public in decision-making processes enables citizens to monitor the process and help identify instances of corruption and undue influence. Increasing awareness of, and support for, the policy is similarly important: studies show that greater public awareness of environmental policies reduces the likelihood of politicians engaging in corrupt behaviour in these areas.

Limit opportunities for corruption through smart policy design

Informed by institutional capacity and corruption risk assessments, countries should aim to match the design of their carbon taxes to their institutional and governance capacities.

Designing options that require new tax administration processes to be developed, as well as a comprehensive national MRV system can create opportunities for corruption, particularly in countries with weak governance capabilities. In these countries, building the carbon taxes on top of existing systems for collecting fuel taxes may be a more workable option, at least in the short term.

Ensuring that regulations are clear and consistent, minimising exemptions and flexibilities, applying uniform tax rates, and limiting the discretion afforded to public officials can help limit opportunities for collusion between companies and public officials in misapplying rules and evading enforcement.

Corruption risks may be reduced by designing the tax to target companies regulated by international standards (eg, Organisation for Economic Co-operation and Development corporate rules), or subject to transparency rules imposed by the stock exchange.

Develop rules for managing conflicts of interest across the policy cycle

In addition to maintaining transparent records of all lobbying activities (see above), governments can manage adopt rules to manage conflicts of interest in policymaking processes. Such rules should limit how those parties who have personal interests in the policy are involved in developing and voting on it. Legitimate avenues should be maintained for interested parties to express their views, such as stakeholder consultation processes. Individuals who have recently left government departments that were involved in the design of the carbon taxes should be limited from lobbying on behalf of companies or interest groups. Similarly, government officials who have recently worked for companies that would be regulated by the taxes (or their lobbyists) may be excluded from participating in policy design.

Contracting independent firms to conduct carbon tax evaluations can reduce the risk of officials manipulating results to indicate better results than have been achieved in reality. However, it is important to exclude any firms that may have their own conflicts of interest in being involved in evaluations.

Where MRV of emissions is required for calculating carbon tax obligations or generating carbon offsets, assigning auditors randomly instead of allowing firms to choose the firms that audit them can reduce the risk of conflict of interest. The integrity of audits and reporting can be further secured by including a second third-party auditor, thereby ensuring that each report is cross-checked by two firms.

Apply clear, consistent, and meaningful penalties for corruption

Credible and proportionately severe penalties may – where they are consistently enforced – help discourage corruption, as well as crimes often linked to corruption such as underreporting emissions, concealment, and tax evasion.

Publicising corruption data as a penalty to ‘name and shame’ entities can discourage corrupt behaviour in countries where reputational risks are a concern for companies.

Most importantly, fines and criminal charges should be in place for penalising corrupt behaviour. These penalties should be applied to bribe givers and takers, recognising that, if public officials are the only parties fined, bribe givers can easily cover their fines or losses by providing additional bribes. To be effective, fines must be sufficiently higher than the financial gain available through engaging in corrupt activity. In serious cases, non-financial penalties should be considered, including imprisonment and revocation of business licences.

Penalties should be relatively standardised and consistently applied, providing as little discretion as possible to enforcement authorities, particularly in countries where corruption is prevalent. For instance, many countries impose a standard fine per tonne of greenhouse gas emissions where the carbon taxes have not been paid.

Ensure that tax authorities are properly trained and adequately funded

By being properly trained in all aspects of the carbon tax administration, tax authorities will be better placed to identify irregularities, including those that may be linked to corruption. Authorities should also be provided with specific training in identifying, addressing, and prosecuting issues of corruption.

Tax authorities and other actors should receive adequate funding to enable them to properly carry out their tasks. Aside from enabling them to better identify irregularities, this also reduces incentives to supplement agency budgets through corrupt payments.

Implement robust financial management and oversight frameworks

Where carbon tax revenue is managed separately from other tax revenue, (for instance in an environmental fund), robust and transparent fiduciary management systems will be required to guard against potential embezzlement by fund managers and other actors. Similarly, where revenues are allocated to specific programmes, oversight is required to ensure that they are properly managed.

Ensure that all contracts are awarded based on transparent public procurement processes

Governments should follow public procurement rules that require fair competition and limit potential for nepotism and cronyism when contracting firms to support the development, implementation and evaluation of carbon taxes, including consultants, auditors and tax collection firms. These rules will often involve a requirement to contract firms pursuant to open tenders and based on predefined selection criteria. However, a tendering process may not be necessary where private collection firms already play a role in collecting fuel taxes, or their place in the fuel distribution chain makes them uniquely placed to collect the carbon taxes.

- The Indonesian government has since announced that it will adopt a carbon tax. However, the tax rate of US$2 per tonne of CO2 will be among the lowest in the world and research indicates it would have minimal impact on emissions reductions.

- While these cases do not relate to emissions reporting for carbon tax specifically, the MRV systems in question are substantially similar to those used in downstream carbon taxes.

- This is supported by stakeholder interviews and focus groups organised by the authors in Colombia and Mexico.

- Those levied at the point of production, import or distribution.

- In some countries, all carbon tax revenue is directed to the nation's general budget, while in others it is set aside for specific uses, such as funding environmental programmes.