Query

Please provide an overview of anti-corruption initiatives in the renewable energy sector.

Background

The presence of renewables in power generation has been steadily growing in both developed and developing contexts, where they are increasingly edging out traditional sources of power, such as coal (IRENA 2015; IRENA 2019). Figures from the International Renewable Energy Agency (IRENA 2020a) reveal that renewables accounted for 24.9% of total energy generation in 2018, the latest year for which data is available. Improved technologies, economies of scale, increasingly competitive supply chains and growing developer experience have resulted in costs of renewables falling sharply over the last decade (Proctor 2020).

However, there are also certain contexts where corruption is being used to hold on to conventional forms of energy and slow the transition to greener energy. For example, in Indonesia, natural resource management is prone to graft through companies bribing regional leaders to gain licences and permits for exploration and exploitation (Adjie 2020). In the past, several high-profile corruption cases related to energy sector policymakers, as well as the perception of the political process being a potential barrier to renewable energy policymaking, points to the fact that the capture and distribution of rents may play a significant role in Indonesian energy management (Bridle et. al 2018). Egi Primayogha of the Indonesian Corruption Watch opines that “widespread corruption in the uncontrolled exploitation of natural resources could lead to a greater use of dirty energy”, while subsequently “hampering transition to renewable energy sources” (Adjie 2020).

Some projections estimate that replacing the most costly 500 gigawatts of coal generation around the world with photovoltaic cells and onshore wind in 2021 could potentially cut power system costs by up to US$23 billion every year (Proctor 2020). Indeed, renewables are now the cheapest way of meeting growing demand in many countries (IRENA 2020a).

The current scenario in the ongoing COVID-19 pandemic has cast some uncertainty over the rapidly growing industry (IRENA 2020b). Ensuing lockdown measures in various parts of the world, along with reduced fuel and electricity demand, have caused delays in the opening of new facilities and bringing new plants online in the renewables sector. Simultaneously, the availability of investments has shrunk since the risk appetite among investors has reduced, affecting future investments and installations. Nevertheless, given the current crisis, more governments are aiming to decarbonise energy, potentially creating support for the renewable agenda (IRENA 2020d).

Nonetheless, IRENA contends that renewable energy “must be the backbone of national efforts to restart economies in the wake of the COVID-19 outbreak” (Proctor 2020). The International Energy Agency (IEA) likewise emphasises that policymakers should consider the broader structural benefits of investing in the increasingly competitive renewables industry, such as economic development and job creation, while also reducing emissions and fostering technological innovation (IRENA 2020c).

Overall, it seems that renewables are likely to continue to grow in importance in electricity markets as utilities and regulators prefer them when it comes to replacing legacy power stations that are being retired (Deloitte 2020). Customer preferences are also contributing to this growth, as consumers increasingly favour renewables to both save costs and mitigate the impact of climate change (Deloitte 2020).

Categorising different renewable energy markets

Renewable energy technologies are vast in scope and can be divided into two main categories: dispatchable (for example, biomass, concentrated solar power with storage, geothermal power and hydro) and non-dispatchable, also known as variable renewable energy or VRE (such as ocean power, photovoltaic cells and wind power).

They may also be on- or off-grid (Tiyou 2019). On-grid systems work in conjunction with the power grid (Tiyou 2019). Such grids can range from relatively small, regional scale to nationwide systems (Kempener et al. 2015). Off-grid systems on the other hand simply refer to “not using or depending on electricity provided through main grids and generated by main power infrastructure” (IRENA 2015). Off-grid systems have a (semi-) autonomous capability to satisfy electricity demand through local power generation, while centralised grids predominantly rely on centralised power stations (Kempener et al. 2015).

While they are also used in high-income states, off-grid systems are becoming increasingly important in meeting energy access demands in developing countries (Kempener et al. 2015). In the absence of existing expensive infrastructure, such off-grid systems often provide a cost effective and quick method to meeting energy needs in remote areas of developing nations (Kempener et al. 2015). In 2019 alone, US$5 billion worth of small-scale solar energy systems were purchased in the Middle East and Africa (Frankfurt School-UNEP Centre 2020).

When it comes to classifying renewable electricity projects, one can distinguish between those driven by government action (for example, auctions and incentives) and those mainly driven by market forces, such as corporate power purchase agreements and merchant projects (IRENA 2020c).

Understanding these classifications of renewable energy markets is important as each category faces different challenges and opportunities (IRENA 2020c). This point is echoed later in the Answer in the section on tailoring corruption assessments and anti-corruption strategies to the particular demands of a given energy market.

Renewable energy markets in the Global South

Some analysts point to the possibility of a “green curse” when it comes to harnessing the potential of renewables in developing countries. PRIO (2019) draws parallels with the “resource curse” that afflicts some countries rich in natural resources that have been plagued by corruption and mismanagement of these resources, which has contributed to violent conflict, autocratic rule and entrenched poverty (PRIO 2019).

While Africa has witnessed a remarkable growth in renewable energy in recent years, PRIO (2019) contends that the continued growth of the sector poses a unique set of challenges for African states linked to the potential for these industries and the mineral value chains that support them to trigger violent conflict (PRIO 2019).

This “curse” is not only limited to the potential for violence, but also for corruption. A study from Italy shows that malfeasance in the renewable energy market is a real risk in countries “characterised by abundant renewable resources and weak institutions” (Gennaioli and Tavoni 2011). In Italy’s case, the authors find some evidence of a “green curse”, by demonstrating that public support for renewable energy schemes can be highly vulnerable to corruption and attract rent-seeking, especially in settings with high levels of organised crime. This suggests that state subsidies and donor funding for the renewable energy sector are particularly vulnerable to the private exploitation of public incentives (Gennaioli and Tavoni 2011).

This implies that political economy analysis of market conditions is likely to be even more critical to renewable energy investments in the Global South, where political externalities, such as corruption and instability, are likely to be greater.

Indeed, in developing contexts, challenges to renewable energy projects often include delays due to environmental or political concerns that arise from inadequate project planning or poor governance and consultation processes (Frankfurt School-UNEP Centre 2020). For example, in Tanzania, the Rufiji dam project is facing controversy due it being built on a wildlife reserve (Dalton 2020). Insufficient planning or consultation can be a red flag for mismanagement or corruption, and it may lead to further incentives for corruption further down the project cycle to accelerate construction through speed money or bribing officials to turn a blind eye to illicit practices.

This underscores the fact that the way corruption manifests itself in the green energy sector may be as much a function of the local context as well as the nature of the sector or the type of investment. Some proposed means of addressing these concerns are covered in the section below on improving governance at the project preparation stage.

The transnational dimension of corruption in the renewables sector

Corruption in renewable energy markets also has an international dimension. Investors, firms and politicians with business ties based in the Global North may all drive corruption in the renewables sector in developing countries. For example, a former UK minister has been accused of breaching the ministerial code after her family firm signed multimillion-pound deals to supply Uganda’s government with solar power equipment (Syal 2020). In another case, Spanish prosecutors are investigating claims that Spain’s largest electric utility company paid US$3.5 million to Chilean politicians in exchange for permission to construct and operate a hydroelectric power plant (Transparency International 2020).

There are plenty of concerning precedents from the extractives industry to illustrate that unscrupulous actors from high-income countries drive corrupt practices in energy markets in the Global South. Recent examples include the energy company Duro Felguera being charged with paying US$105 million in bribes to a senior Venezuelan official, and Chinese businessmen being convicted by US prosecutors of bribing Chadian and Ugandan officials to secure oil rights for CEFC China Energy Company (Transparency International 2020).

While the oil and gas industry clearly differs from the renewables sector in key aspects, a number of energy companies from the oil and gas world are increasingly moving into renewables, and potentially bringing their dubious business practices with them. One example is the former head of global sales at the British energy services provider Petrofac Limited who pled guilty in 2019 to making corrupt payments to secure oil contracts in Iraq and Saudi Arabia (Transparency International 2020). Petrofac Limited makes no secret of its ambitions in the renewable energy market (Petrofac 2020).

Overview of the renewable energy supply chain and the actors involved

Renewable energy supply chains include physical, information and financial flows (Wee et al. 2012). The exact structure of the supply chain depends on a number of variables that influence the nature and severity of corruption risks likely to be encountered (Lu et al. 2019). These variables include endogenous factors such as the energy source in question (wind, solar, hydro or biomass) as well as the external legal, institutional, political and social environment in which energy is produced, transformed and used.

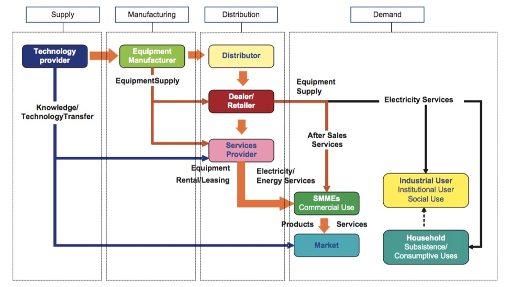

Figure 1. Schematic of the renewable energy supply chain

Source: UNDP, Wee et al. (2012) and Saavedra (2018).

Stakeholders in renewable energy value chains generally go beyond traditional actors (such as technology provider, manufacturer, distributor and user) to include (UNDP 2015):

- government bodies

- civil society organisations (CSOs)

- private technology companies

- financial institutions (such as banks, microfinance institutions and cooperatives)

- retailers

- business incubator networks

- impact investors

- extension service providers

- local community networks (i.e. farmers’ networks)

Some donor agencies also play a significant role as convenors and financiers in renewable energy markets in aid-recipient countries. Beyond traditional forms of development assistance, such as grant giving, the green energy sector has become something of a petri dish for approaches such as blended finance (Climate Policy Initiative 2018a).

Such donor interventions have sought to reduce barriers to private sector investment in the green energy sector, which include risks related to currency volatility, liquidity and the policy environment. Despite the falling costs of clean energy, these risks are often sufficient to make potential investors balk at the prospect of entering markets in low-income countries. This is a particular problem in the early stages of a potential project, such as “start-up off-grid companies or grid-connected projects that face policy and permitting uncertainty before they even advance to construction” (Climate Policy Initiative 2018b).

A number of donors are therefore engaged in programmes that seek to provide expertise, technical assistance and, above all, capital that give private companies the confidence to enter the market and expand access to energy for people who would otherwise be without electricity (Sida 2020). The provision of such financial support by donors to private entities in the form of loans, guarantees, equity and other financial instruments is intended to encourage the private sector to make investments in developmental projects that are not otherwise financially viable on market terms.

Figure 2. Methods employed by Sida as part of its Power Africa programme

Source: Sida 2020.

The various methods employed by this type of financing – from seed funding to commercial loans and results based financing – can each involve a large number of actors. The OECD (2018: 65) has pointed out that the complex financing arrangements and multi-layered governance structures involved in blended finance can affect the “management and perceived transparency” of a development project, as monitoring the financial transactions and development results generated becomes difficult due to the sheer number of participants. This is perhaps particularly germane in the energy sector, where Lu et al. (2019), point to the large number of suppliers and third-party intermediates as a corruption risk.

Table 1. An overview of potential actors at different stages of the renewable energy value chain.

|

Level of value chain |

Actors |

|

Policymaking |

international organisations; financial institutions, government bodies; impact investors |

|

Resourcing |

private technology companies; government bodies, financial institutions; local community networks |

|

Procurement |

government bodies; bidding companies |

|

Manufacturing |

public and/or private utility companies |

|

Service delivery |

distributors; retailers; technicians; commercial and household users |

For further information on integrity risks in blended finance modalities, see Transparency International. Better Blending: Making the Case for Transparency and Accountability in Blended Finance(2018).

Potential forms of corruption in the renewables sector

As with the extractives sector, the renewables industry requires substantial capital investments, which can come with substantial political risk. Similarly, government subsidies and the issuance of renewable energy certificates attract rent-seeking behaviour (Moliterni 2017).

Corruption is a significant obstacle to the development of sustainable energy systems due to the sector’s vast potential to generate rents (U4 Anti-Corruption Resource Centre 2019). Grasso (2020) points to the enormous amount of money involved in energy transactions, resulting in immense corporate wealth, which often allows energy companies to obtain an unfair advantage in the political marketplace (Grasso 2020).

As such, undue influence is an ingrained challenge, given the economic clout and political influence of energy companies who lobby regulators and legislators, in some cases seeking to frustrate progress towards a green transition (Rimsaite 2019).

As well as a source of corrupt funds that can be used by unscrupulous energy firms to distort markets, policies and political processes, the energy sector is also a target in the sense that corrupt political actors seek to extort money or solicit bribes from the industry (U4 Anti-Corruption Resource Centre 2019).

Vulnerability to corruption in the sector also arises in the presence of public subsidies, both in the fossil fuel and renewables markets. These funds may be subject to discretionary use to favour certain interest groups or simply be misappropriated, especially in countries with weak social capital and institutions (Lu et al. 2019).

The type and extent of corruption encountered will depend on both the supply chain of specific energy sources as well as the broader governance environment in a country.

A guide from the U4 Anti-Corruption Resource Centre (2019) identifies a number of forms of corruption in the renewable energy sector:

- diversion of public spending intended for renewable energy subsidies

- inflating the cost of developing renewable energy infrastructure

- inefficient allocation of public contracts for renewable energy to those willing to bribe rather than those best able to deliver the required service

In addition to these, some other forms of malpractice are listed below.

Tender rigging

National energy markets tend to be relatively well integrated, which can give rise to concerns about collusive behaviour such as market sharing agreements, customer allocation or bid rigging (Calzado et al. 2015). In 2003, the French National Crime Agency fined three renewable energy companies (Apex BP Solar, Vergnet and Total Energie) for market sharing and bid rigging, as well as the renewable energy trade union (Siprofer) for facilitating and enhancing the anti-competitive agreements (Calzado et al. 2015). Rigging is not always from the supply side, but may be a product of the demand side of corruption. For example, a report from EY (2015) cautions energy companies about governments rigging auctions and restricting competition to favour certain applicants, potentially in exchange for kickbacks.

Bribery, mismanagement and inefficiency

Around the world, at the point of service delivery, bribery to attain access to energy connections is a prominent form corruption in the sector (Boamah and Williams 2019; Transparency International 2019). Moreover, failure to set tariffs, collect revenue, monitor private partnerships and investments in energy can result in major energy losses in transmission and distribution (APP 2015b).

Theft

Non-technical losses in the energy sector, including the renewable sector when the supply is attached to a utility grid, are caused by (APP 2015b):

- individual actors, either purposely, via theft, or unintentionally, through errors in accounting, for example

- faulty equipment that is not directly used to supply power; for example, metres

The World Bank’s suggested benchmark for non-technical losses in Africa is 10% of the total power produced. However, in some African countries, this figure may be more than two or three times higher (APP 2015b). Most of these losses are caused by electricity theft, typically by tampering with or bypassing metres, often in collusion with corrupt utility officials (APP 2015b).

Most of this theft is not carried out by citizens unable to afford electricity but by individuals and organisations consuming large amounts of energy with the ability to pay for it. This list of offenders often contains government, corporate, industrial and commercial groups (APP 2015b). The risk of being sanctioned is undercut by inefficiencies on the part of the utility companies to act, or through corruption in the form of bribing officials and the use of patronage relationships (APP 2015b).

Electricity theft in collusion with corrupt officials is particularly problematic as it starves utility providers of revenue, undermines their ability to provide better infrastructure and expand access, while increasing costs for those who do pay (APP 2015b).

Anti-corruption strategies

Assessing how corruption operates in the sector

In their study of the Kenyan energy sector, Boamah and Williams (2019) stress the importance of understanding how corrupt practices benefit those who engage in corruption as a first step to tackling it. They find that corruption in the Kenyan energy sector is largely driven by poor planning and the inability of the electricity market to rapidly expand access, which leads to people turning to corruption as a “problem-solver” – a means to secure connections to the power grid. According to the authors, tackling corruption in this setting is as much about providing clear fee structures, clarity on eligibility requirements for electrification initiatives and designing the rollout of the system in line with the capacity of engineers to expand it as it is about sanctioning corrupt behaviour after the fact. In this sense, they argue for tackling the root causes of corruption in energy systems rather than focusing exclusively on corrupt symptoms of a deeper malaise.

Ultimately, the long-term sustainability of renewable energy investments relies on a profound grasp of interactions between relevant stakeholders and how they will need to cooperate to maintain the established systems and infrastructure. This requires forward planning and transparent partnerships (EITI 2018).

Corruption risk assessments

Corruption risk mapping can play an important role in the process of grasping how corrupt practices operate in a given sector. An example of this type of exercise is a recent report by the Oxford Institute for Energy Studies, which assessed corruption risks in the renewable energy sector in Ethiopia and Kenya (Gordon 2018). It found that the investment risk profile in each country dictated the type of renewable energy projects being undertaken.

Since the risk in Ethiopia primarily occurs at the political and regulatory stage, with hidden barriers to market entry, investors were likely to be more reliant on government support to implement a project. At the same time, gaps in the legislation have hitherto prevented the rapid expansion of private off-grid investment, while the government has tended to prefer large utility-scale projects (Gordon 2018).

On the other hand, in Kenya, asset risks are significantly higher and regulatory gaps are fewer. Challenges in land access and a high risk of protests also leads to substantial delays to larger on-grid projects. Thus, while projects with a sizable physical presence can flounder, off-grid options do not encounter much opposition in the Kenyan context (Gordon 2018).

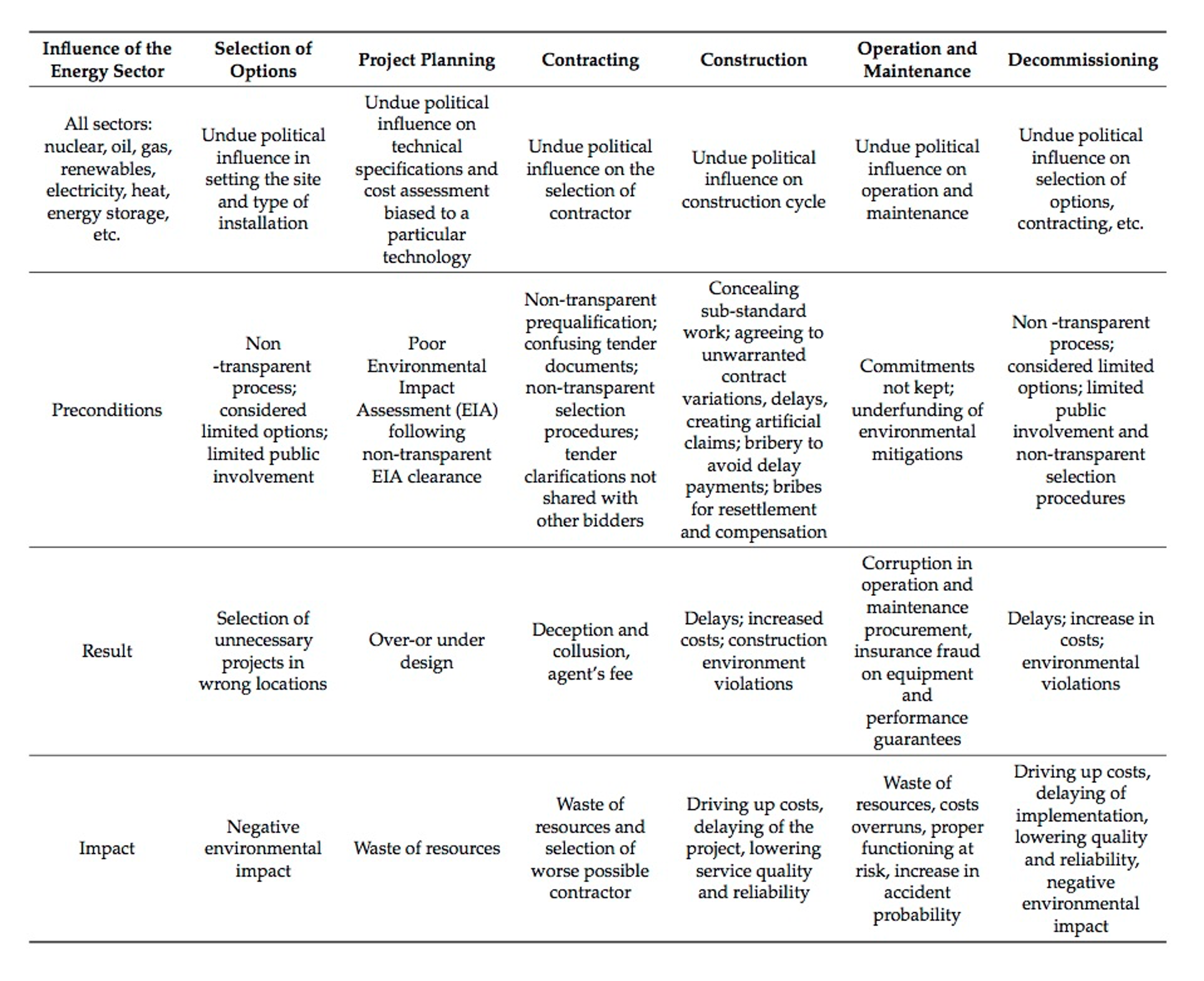

Therefore, while some general schematic corruption risks can be identified as pertinent to the sector (see annexes I and II), there is a clear need for both extensive political economy analysis to understand the policy and political environment, as well as extensive due diligence to identify project-specific risks.

Improving governance at the project preparation phase

A key area of concern for potential investors, especially in the sub-Saharan context, is transparency conditions at the project’s design stage (project appraisal, selection, design and budgeting). This is because misconduct or mismanagement at this initial phase paves the way for corruption at later project stages (Sobják 2018).

Reducing corruption risks and improving governance at the project preparation phase may be achieved by (Sobják 2018):

- dividing project preparation into four different steps: i) project development and initial screening; ii) formal project appraisal; iii) independent appraisal review; and iv) project selection and budgeting. A country-specific political economy analysis will help identify whether the project is purposefully serving insider interests, as well as the most suitable entry points and measures to tackle this issue.

- building capacity inside the appropriate ministries, provincial or local governments for project appraisal, budgeting and design. It is important to ensure that each of these project phases takes place in an entity with the necessary capacity.

- improving the transparency of the decision-making procedures surrounding the project preparation; for instance, through the full disclosure of the feasibility studies

- using various innovative tools developed by development financial institutions and non-governmental organisations (NGOs) that assist in evaluating and benchmarking project development in line with international practices. The most renowned ones are the Project Readiness Assessment Tool from the Global Infrastructure Facility and the International Infrastructure Support System of the Sustainable Infrastructure Foundation.

Transparency requirements and community involvement

The importance of transparency in the energy sector is well documented (Grasso 2017; Lu et al. 2019; Grasso 2020). The Africa Progress Panel (APP 2015a) notes the relevance of beneficial ownership provisions in the industry to help curb illicit financial flows, arguing in favour of transparent reporting on energy contracts, including electricity off-take arrangements (APP 2015a). This is echoed by the Extractive Industries Transparency Initiative (EITI) (2018) who point out that beneficial ownership transparency becoming part of licensing requirements in the extractives industry has helped rein in the influence of politically exposed persons, and that such measures could be introduced in large-scale infrastructure projects in the renewables sector.

EITI has published some further guidance entitled What the Extractives Sector Can Teach Renewables on Curbing Corruption (2018). The authors stress the importance of clear legal procedures to ensure that the award process for renewable energy projects is objective and transparent, deters clientelism and ensures the selection of capable and qualified implementing partners (EITI 2018).

Research by Ikejemba et al. (2017) evaluated failed renewable energy projects in sub-Saharan Africa. Similar to Sobják’s (2018) work, Ikejemba et al. find that corruption during the process of awarding a project was typically decisive in a project’s failure. This is because, where a project has been approved on corrupt or nepotistic grounds, it is hard to enforce rules or sanction later misdeeds. The authors propose that the most effective way to guard against the failure of renewable energy projects in sub-Saharan Africa is to embed transparency, community ownership and shared responsibility across the project cycle.

Making projects sustainable through localisation

Boamah and Williams’ work (2019) on Kenya demonstrates how tailoring energy systems to the needs of the communities they serve can bring positive results. The use of pre-paid monitoring systems in informal settlements combined with penalties for power theft has helped curb corrupt practices in the country, but the authors argue this has to be reinforced by proactive measures designed with local conditions in mind. Based on an analysis of the situation in the country’s periphery, they propose educational outreach activities on how to secure a connection to the grid, as well as efforts to streamline the application process.

Work by UNCTAD (2014) suggests that so-called local content requirements can be relevant in the renewables sector as a means to localise spending and create employment. UNCTAD nonetheless includes a cautionary note that local content requirements that “re-direct rents arising from economic undertakings” can either be used constructively to benefit local communities, or alternatively serve as a means to enrich well-connected individuals and fuel corruption.

Managing potential backlash from fossil fuels lobbyists and their political allies

An example from South Africa shows that the renewable energy sector may also encounter backlash from government utilities aiming to protect their own interests in non-renewable energy. A proposal to build 96 privately owned and run utility-scale renewable energy plants was shot down by the state utility, Eskom, citing concerns over financial sustainability (Joubert 2016).

However, the South African Wind Energy Association (SAWEA) has accused Eskom of obstructionism and orchestrating a deliberate anti-renewables campaign to protect its own coal investments (Joubert 2016). Later, the South African Renewable Energy Council (SAREC) claimed that deliberate delays by Eskom were related to a corruption scandal at the highest level of government. A report released by the Office of the Public Protector cited unethical conduct by then-president Jacob Zuma and other functionaries that resulted in “improper and possibly corrupt award of state contacts and benefits” to the Gupta family. These awards pertained to coal interests (Joubert 2016).

IRENA (2018: 21) points to the broader trend of “political or other resistance to renewable energy – such as institutional corruption and anti-renewables lobbying”. As appears to have been the case in South Africa, such entrenched opposition to a shift to renewables often comes from a corrupt business-politics nexus with vested interests in the fossil fuels sector.

In such cases, anti-corruption practitioners could look for common ground with green energy advocates to break the chokehold of corrupt(ing) fossil fuels interests over public energy policy. A starting point might be initiatives to monitor fiscal incentives, financial grants and subsidies to the fossil fuels industry (IRENA 2019: 14), as well as tracking the industry’s “legislative footprint”.

Understanding institutional context

While recent advances in off-grid renewable technologies promise to advance energy access at a rate and cost that would not be possible if grid expansion was the only option available, it is important to note that focusing solely on the technology and overlooking the importance of the institutional context in which that technology is being delivered may be counterproductive (Morrissey 2017).

Indeed, Boamah and Williams’ Kenyan case study (2019: 8) highlights that the growth of decentralised, off-grid photovoltaic systems is not itself a “remedy” to corruption in the electricity sector, as the high prices of these units has driven other forms of corrupt behaviour, such as the “illicit use of unlicensed technicians”.

In many countries, reforms of corrupt and/or dysfunctional energy utilities have involved commercialisation and the introduction of competition. However, scholars note that the impact of such privatisation on people with limited access to energy has been difficult to assess, with much of the credit for increased rates of access being accorded to public policies and subsidies (World Bank 2005). Critics of utility reform argue that it has limited effects on expanding energy access, as private sector participation tends to result in tariff increases (Morrissey 2017).

Existing literature on energy access consistently sees that “weak institutional structures and organisational systems contribute to the poor performance of projects...Economically viable projects can fail simply because of an inadequate appreciation of the importance of appropriate organisational structures and institutional arrangements. Past experiences also show that a large number of off-grid electrification projects have had limited success...because of the disproportionate focus on technical installation without adequate attention to the long-term sustainability of the projects” (Palit and Sarangi 2014).

In Africa, where utilities often function as sites of patronage, efforts to expand energy access must therefore go hand-in-hand with greater institutional accountability (Morrissey 2017). However, it ought to be noted that political and economic determinants of institutional responsiveness may be more complex than is often portrayed in the literature on good governance and institutions. For example, studies that have sought to explain energy access with reference to governance metrics and corruption indicators have been found to lack any power when it comes to explaining electrification rates across countries (Wolfram et al. 2012). It is however interesting to note that utilities (including electricity and water) were perceived to have the highest bribery rates in Africa, according to the tenth edition of the Global Corruption Barometer (GCB) – Africa (Transparency International 2019).

Finally, government backing and strong political will is generally a pre-condition for the successful implementation of renewable energy programmes (Schillebeeck et al. 2012). Policy and regulatory environments matter, as does public financial support to provide subsidies and underpin supply chains.

Despite the increasingly significant role of private companies in electrification, public sector utilities will remain a crucial part of the picture, implying an ongoing need to focus on improving the responsiveness and accountability of public energy institutions (Morrissey 2017). Transparency, in all sectors and phases, including but not limited to procurement, beneficial ownership information, allocation of subsidies and financial incentives and project implementation becomes a cornerstone for accountability. It is such transparency and accountability in the sector that creates confidence for renewable energy markets (Fowler 2020).

Examples of existing good governance initiatives in the renewables sector

Using agreements to bolster transparency mechanisms

Power purchase agreements that set key terms between buyers and sellers of renewable energy can be a good way to negotiate not only the volume and the price of electricity but also regulatory terms, based on transparency and a profound market understanding (Raconteur 2019).

One example of such an agreement is Open Solar Contract, a standardised contract documentation that is freely available and designed to be universally applicable. Prepared by International Renewable Energy Agency (IRENA) and Terawatt Initiative, the contract contains confidentiality provisions, force majeure provisions, anti-bribery and corruption provisions, dispute resolution mechanisms, and representations and warranties (IRENA and TWI 2019).

Transparency platforms for the sector

The European Union’s (EU) renewable energy transparency platform, created under Article 24 of the Renewable Energy Directive, provides public access to a range of documents related to EU renewable energy rules. The documents range from EU countries’ national renewable energy action plans, national renewable energy forecasts, European Commission (EC) assessments of excess energy production and estimated import demand, and other national and EC documents related to renewable energy. The rationale for such a platform is to facilitate cooperation between EU countries on renewable energy (EC 2020).

Multi-donor funds

The top four donors actively supporting renewable energy projects include the World Bank, Ministry of Foreign Affairs Japan, Germany and International Climate Initiative (D-portal 9272268f328c A few illustrative examples of projects which tie in good governance initiatives are as follows.

Global Environment Facility (GEF)

With World Bank serving as the trustee,8d0e0c9dc01d GEF has invested around USD 10 billion in over 200 renewable energy projects in developing and emerging economies (Williams and Dupuy 2016). Through setting fiduciary standards that partner agencies are expected to meet, advancing civil society participation and exhibiting a number of best practices regarding transparency, Persson et al. (2014) contend that GEF has the ability to advance anti-corruption work in the sector.

Sustainable Energy Fund for Africa (SEFA)

SEFA is managed by the African Development Bank (AfDB) and aims to support sustainable private sector led economic growth in African countries through the efficient use of clean energy resources. Through its enabling environment grants, it encourages public sector activities that create and improve the supporting systems for private sector investments in sustainable energy. The creation of such environments has an impact on overall governance infrastructure (NDC Partnership, n.d.). In April 2020, SEFA approved a US$760,000 grant to Empower New Energy AS (EmNEW) to develop at least eight small renewable energy projects in Africa (AfDB 2020).

ODA from the United Kingdom, including Department for International Development (DFID) and UK Department for Business, Energy and Industrial Strategy (BEIS)

Green Africa Power (GAP): the main objective of this initiative was to stimulate private investment in renewable energy in Africa by acting as a long-term source of financing and policy support to projects by reducing the upfront cost of capital while sustaining overall commercial returns, offering protection for specific development phase risks and facilitating policy dialogue to move towards cost-reflective tariffs (DFID 2017).

Harvesting the sun twice (enhancing livelihoods in East African agricultural communities through innovations in solar energy): focused on East Africa, this project aims to gather empirical evidence on the potential benefits of solar agrivoltiac (AV) systems, which allow the delivery of solar-generated electricity, crop production and rainwater harvesting on the same land area. The project focuses on equitable partnerships with local agencies throughout the project lifecycle (BEIS 2020a).

Global Energy Transfer Feed-in Tariff (GETFiT): mitigation of energy shortfall and promoting private sector investment in renewables in Uganda is the project’s objective. In doing so, it supports small-scale on-grid renewable energy schemes. The idea is to show the positive effects of effective regulatory regimes and cost-reflective tariffs in bringing in investment in renewables (BEIS 2020b).

Furthermore, in 2013, DFID, in conjunction with the UK Cabinet Office, published anti-corruption strategies for all of the countries DFID worked with. These policies were required to be a part of DFID projects operating in the relative contexts (DFID and Cabinet Office 2013).

Power Africa and Beyond the Grid Fund for Africa

Power Africa, a US government-led partnership, has joined the Beyond the Grid Fund for Africa (BGFA) initiative (BGFA 2020). BGFA is implemented by Renewable Energy and Energy Efficiency Partnership (REEEP), while being managed by the Nordic Environment Finance Corporation (NEFCO) and funded by Sweden. The main aim of this project is to bring clean, affordable off-grid energy access to people in Burkina Faso, Liberia, Mozambique and Zambia (REEEP 2020).

Currently, there are ongoing calls for proposals inviting off-grid energy companies to compete for results based funding. The idea is to encourage new sustainable business models that incentivise and stimulate the private sector to provide affordable and clean off-grid energy access at scale in the countries of focus (NEFCO 2020).

Global Energy Transformation Programme (GET.pro)

This is a European multi-donor platform delivering on international energy and climate goals (GET.pro 2020). The programme assists in rallying private investment for decentralised power generation from renewable sources, advises partner governments on energy transition challenges, and acts as the secretariat for the Africa-EU Energy Partnership (BMZ 2020). By offering its instruments, central coordination functions, administration, financial management and a robust monitoring and evaluation system, it increases efficiency and accountability at all project levels (GET.pro 2020).

German Federal Ministry for Economic Cooperation and Development (BMZ)

Green People's Energy for Africa initiative: seeks to empower local actors, such as community groups, cooperatives and municipalities to generate and productively use decentralised energy supplies of solar, water, wind and biomass (BMZ 2018). The target countries are Benin, Côte D’Ivoire, Ethiopia, Ghana, Mozambique, Senegal, Uganda, Zambia and Namibia (GIZ 2018). Forging partnerships and increasing local capacity are key features of this project.

Annex I

Corruption risk mapping in the energy sector. Source: Lu et al. (2019)

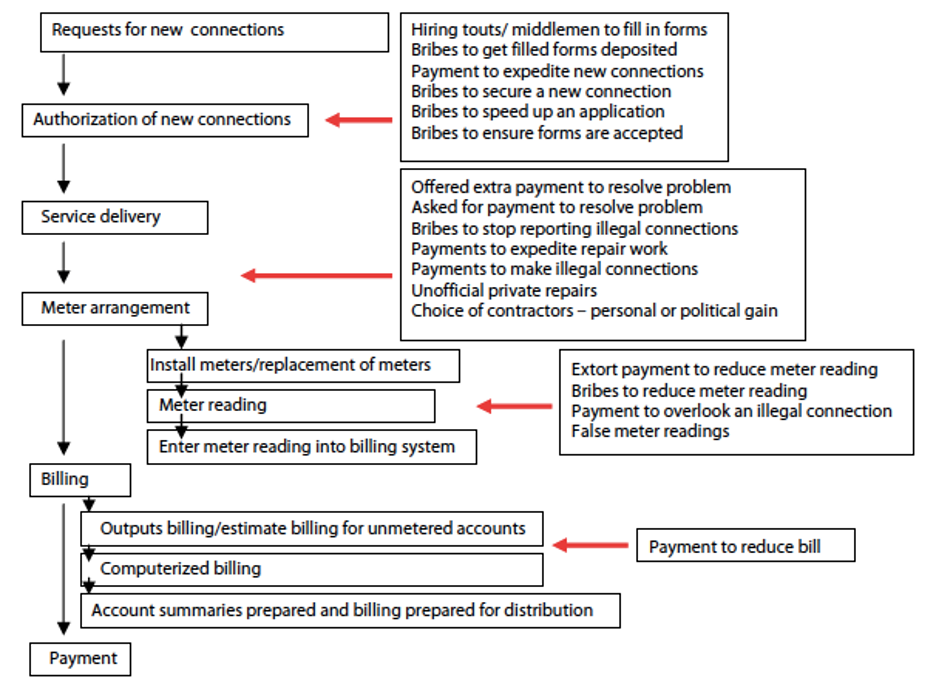

Annex II

Corruption risks in the energy sector at the service delivery level. Source Cavill and Sohail (n.d.).

- It offers a search function and information by country or by publisher on development activities and budgets published to the International Aid Transparency Initiative (D-portal 2020).

- The GEF trustee administers the GEF Trust Fund (contributions by donors); helps mobilise GEF resources; disburses funds to GEF agencies; prepares financial reports on investments and use of resources; and monitors the application of budgetary and project funds. The trustee creates periodic reports that contain an array of fund-specific financial information (GEF 2020).