Blog

Beneficial ownership disclosure at the UN General Assembly against corruption

Will countries step up to agree ambitious new global standards on beneficial ownership? The United Nations Special session of the General Assembly against corruption (UNGASS), on 2–4 June 2021, is an opportunity to do just that. To inform the ongoing negotiations around a political declaration on corruption, Transparency International launched a petition in December 2020. The petition, submitted to UNGASS on 24 February 2021, called for “an end to the abuse of anonymous companies and other legal vehicles that facilitate cross-border corruption and other crimes.”

The signatories – over 700 in total (including U4) from 120 countries – are asking governments to establish centralised, public registers of beneficial ownership as the new global standard, and to make sure that beneficial ownership data is verified and up-to-date. The FACTI Panel (a high-level group established by the President of the UN General Assembly and the President of the Economic and Social Council in 2020) produced a report in February 2021, which comes to a similar conclusion, recommending the UN to take the lead by adopting a global standard.

Identifying the beneficial owners will end secrecy

Since 2016 the Panama Papers, the Paradise Papers and the FinCEN files have exposed how the secrecy and the systematic use of opaque and anonymous corporate legal entities have enabled companies and public officials around the world to hide the proceeds of corruption, launder funds or avoid taxation.

Identifying who hides behind these legal entities is crucial, even under normal circumstances. And because governments are spending trillions of dollars with opaque or unknown companies in their efforts to tackle Covid-19 (eg, in the UK, Slovenia and Honduras) the need for transparency is even more urgent.

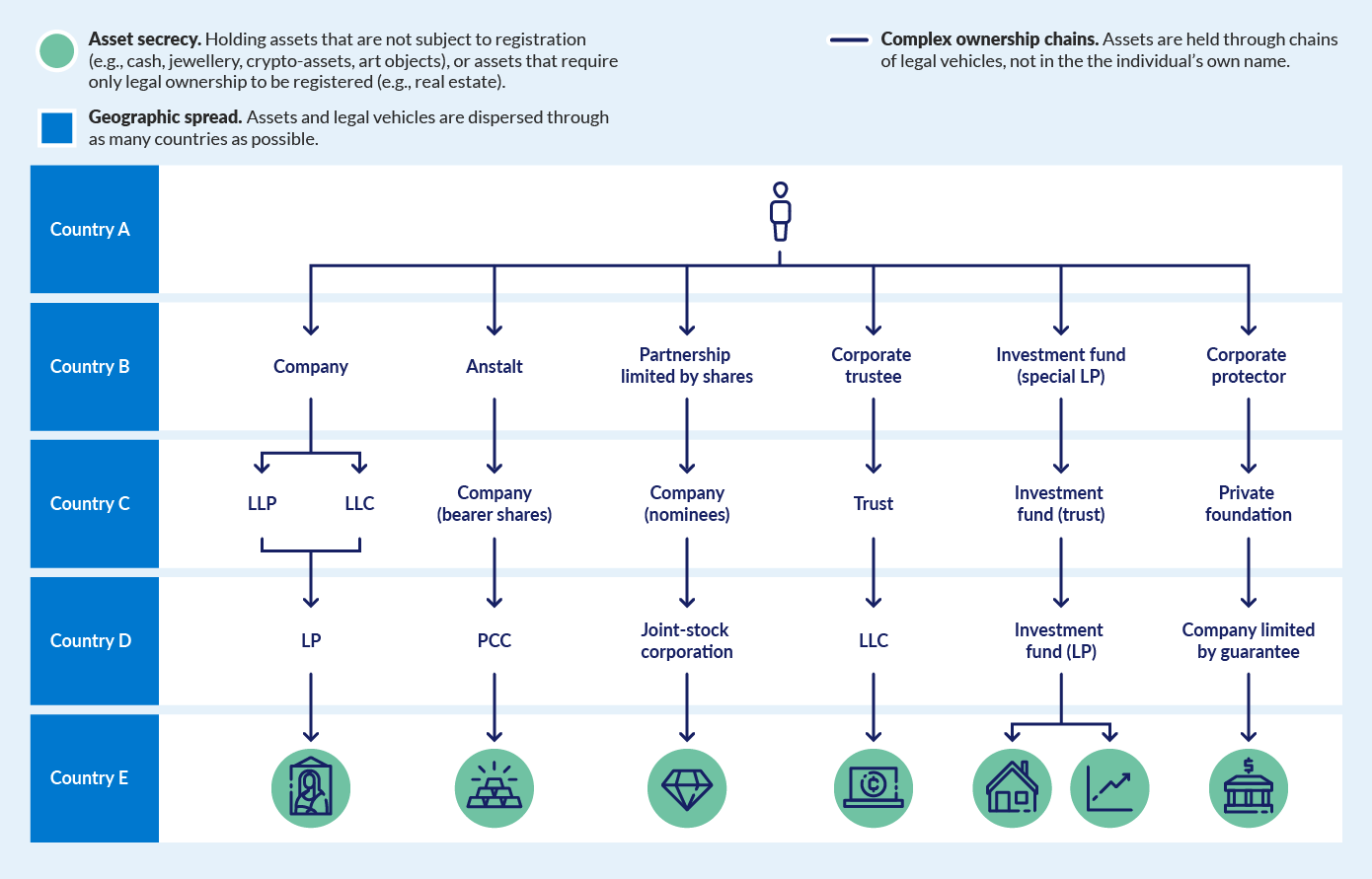

Types of secrecy: Asset secrecy, geographic spread and complex ownership chains

Shining a light on those who own and control corporate legal entities (eg, companies, trusts or foundations) is an effective way of disrupting and deterring corruption, money laundering and tax avoidance practices. Beneficial ownership disclosure offers such a response, by revealing the real flesh-and-blood person who ultimately controls the legal entity not only directly and overtly, but also indirectly and covertly, invisible to the outside world (see the World Bank's Puppet Masters report for more on this).

Good work is happening worldwide

In the wake of these revelations and scandals, and many others besides, we are seeing a global movement towards disclosure of beneficial ownership and the establishment of beneficial ownership registers. In 2016 the UK and the European Union were among the first to establish beneficial ownership registers. Since then over 80 countries have adopted legislation requiring companies to register their beneficial owners.

The adoption of the Corporate Transparency Act in the US in January 2021 and the commitment by the UK Overseas Territories to adopt publicly accessible beneficial ownership registers by the end of 2023 are the latest steps towards global transparency. In total, 109 countries have committed to disclosing beneficial ownership.

Some countries have already set the bar high, giving an example for others to follow. For example, Ecuador’s beneficial ownership register is considered to be the most ambitious and comprehensive anywhere. Ukraine was among the first to establish a public and free online beneficial ownership register, followed by countries such as Denmark or Slovenia. Some countries (eg, Argentina, Botswana and Ecuador) do not apply any thresholds for disclosure, meaning anyone holding at least one share must disclose its ownership.

OpenOwnership provides support to governments that want to implement beneficial ownership transparency. It also connects registers around the world to create a single, global, open and free register. And more recently, OpenLux, an investigation conducted by 17 media organisations, has highlighted how information included in the Luxembourg public beneficial ownership register can help to uncover suspicious practices.

Challenges remain

Despite many examples of good practice, and good intentions, these laws and registers differ in scope: for example, the type of corporate legal entities covered, the level of detail held about the beneficial owner, the threshold set for disclosure, how accessible they are to the public, or the verification of information (see the Tax Justice Network 2020 State of play of beneficial ownership for a thorough analysis).

Many also suffer from slow implementation, lack of controls and enforcement, as well as loopholes that allow some actors to evade scrutiny (see U4’s analysis of Nordic countries’ systems, for example). It is therefore crucial to set common standards to ensure a level playing field and true and effective transparency of beneficial ownership.

The UNGASS is a unique opportunity

The UNGASS in June 2021 represents a tremendous opportunity to set ambitious standards to tackle impunity. Countries must seize it. They should share their best practices on beneficial ownership disclosure, and show strong leadership so that the UNGASS political declaration will be commensurate with the challenge the world faces.

Disclaimer

All views in this text are the author(s)’, and may differ from the U4 partner agencies’ policies.

This work is licenced under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International licence (CC BY-NC-ND 4.0)